Many of you have probably heard about 5 second rule before.

Usually it is related to dropping food on the floor, but if you pick up the food within 5 second, you can still eat it.

The 5 second rule I am talking about is a book written by a public speaker called Mel Robbins.

The rule is really simple – here’s the definition from her site.

“If you have an impulse to act on a goal, you must physically move within 5 seconds or your brain will kill the idea.”

If you have an impulse or a thought to start a business, make sure you get up, write it down within five seconds. Otherwise you will forget about it and do nothing about it.

And years later, you are still the same as you were five years ago.

This rule is indeed a practical skill you can apply to your everyday life.

For example, I apply this to my 4:30am wake up habit every morning.

When I lie in bed inside my warm and fuzzy blanket, I learn to count from 5-4-3-2-1 to get up.

It’s ugly most of the days. But that’s how I get up in the morning.

I count down and I force myself to get up.

It’s the counting that stops your brain from giving all kinds of excuses and reasons why you should stop from taking action.

It’s the counting that activates your prefrontal cortex, a part of the brain that’s responsible for planning and contributes greatly to personal development. It forces us to stop finding excuses and to get going.

Next time when you find yourself making up excuses not to go to the gym, try counting down 5-4-3-2-1, get up and go.

When you find yourself dragging the task you know it’s important to achieve your goals, count 5-4-3-2-1 and start working on them.

Writing this week’s blog post surely is a drag – it’s been a couple of weeks since I last wrote one. Momentum is lost and I have writer’s block. Oh well, 5-4-3-2-1, here I go!

The Ontario Government released their 2017 budget a couple weeks ago. As many of you heard, they have imposed the 15% foreign buyer tax credit in Golden Horse area and closed a loophole on rent control in Ontario.

As an immigrant myself, I feel compelled to share my thoughts on these recent changes.

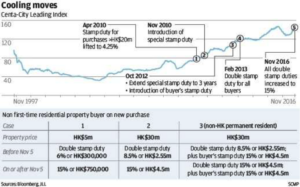

As you can see from the above chart, Hong Kong is ranked the most expensive city to own a property. I happened to be raised there.

Without parents help, its extremely difficult for millennials to own any properties.

Hong Kong does not only have a foreign buyer tax on residential properties, they also doubled their stamp duty (ranging from 4% to 8% of their property value) for second time home buyers and foreign buyers.

In another word, they do not only tax the foreign buyers, they’re also taxing all real estate investors buying more than one home.

The chart represents secondary private residential property price in Hong Kong over the years.

None of the measures seem to have much long term impact on the rising housing market.

And of course, if you compare affordability of Hong Kong housing to Toronto, our houses are definitely a steal.

If you think Hong Kong isn’t a proper comparable to Toronto, we can also look at the rules itself.

If you look at the rule closely, the 15% foreign buyer tax does not apply to permanent residents, foreign nationals working in Ontario and International students.

Canada’s target immigration is about 300,000 for 2016. About 39% comes to Ontario, that’s 117,000 people who came to Ontario last year alone.

To give you some perspective, in 2016, Barrie has an estimated population of 141,000 people.

In another word, the number of immigrants who came to Ontario in 2016 was equivalent to 80% of Barrie’s total population.

They may not buy a house immediately but they would still buy in a few years.

I was a new immigrant in 1999. We rented a place at Finch & Don Mills in Toronto. We were told the market would not rise and hence we didn’t buy a place immediately.

My parents set aside some money before coming here. They wanted to buy immediately.

We were by no means a wealthy family, but my parents wanted a better future for their kids. To qualify to come to Canada, my dad had to apply under the entrepreneurial program whereby he agreed to open a small business and hire locals.

Many of the immigrants came through similar programs. They all had some sort of expertise and money to start a business and ready to contribute to the local economy.

Sure enough, some immigrants don’t come with money, but many do.

And that immigration number, 117,000 in 2016, is expected to be consistent in the foreseeable future.

The root cause to rising housing market is immigration. Not foreign buyers who never step foot in Canada.

What about those international students?

In Ontario alone, there are 188,000 international students in 2016. This group of students are all exempted from the 15% foreign buyer tax.

In case you don’t know, these students pay anywhere between 2.5 to 4 times of what local students pay to study in our country.

If you complain about how expensive colleges and universities are, they pay way more than us.

They come with money, probably a lot of money!

Truth to be told, I met many international students and a few end up buying houses when they’re on student VISA.

However, many would apply to stay in Canada afterwards and become one of the immigrants mentioned above.

Cooling measures are absolutely necessary, so we, as real estate investors, can have less competition when buying.

But cooling measures do not change the economic fundamentals of supply and demand.

Adapt and take advantage of the short-term slump!

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant