Anything that reduces your tax bill, may it be a tax deduction or credit, is worth learning about. Wouldn’t you agree?

When politicians are claiming that they are “putting more money back into the pockets of Canadians”, not every policy carries the same amount of impact as others.

Some put more money into your pockets and while some appear to be big, the impact can be extremely small.

Real Estate Investors often confuse tax credit with tax deductions and ask me, what’s the difference and which one is more beneficial to them?

While they both sound very similar, they provide significant differences in impact.

What is a Tax Deduction?

Tax deductions are basically the eligible expenses you claim to reduce your taxable income. For example, if you made $100,000 last year and claimed $10,000 in approved deductions, you would only have to pay tax on a reduced taxable income of $90,000.

To truly understand the impact of a tax deduction, we need to first get a better understanding of how the Canadian personal tax system works.

Progressive tax system

How does the government increase Canadian housing? The government does the biggest thing that they can do – set a ban on foreign investment in Canadian housing. Yes, they are going to impose a ban on foreign investment on resid

The Canadian personal tax system is a progressive tax system. The more income you earn, the more taxes you will have to pay.

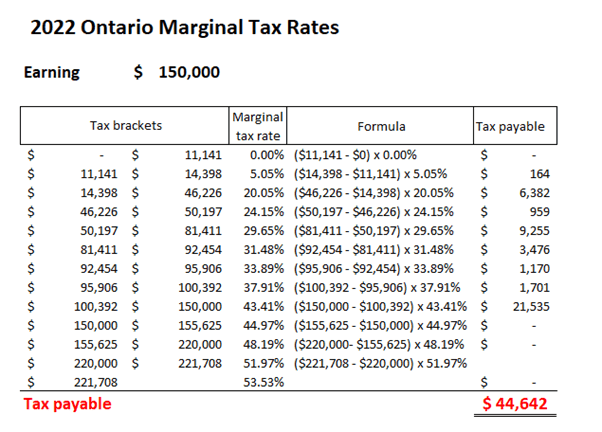

The chart below shows the marginal tax rates for Canadians residing in Ontario in 2022:

| Income range | Marginal tax rate |

| $0 – $11,141 | 0% |

| $11,141 – $14,398 | 5.05% |

| $14,398 – $46,226 | 20.05% |

| $46,226 – $50,197 | 24.15% |

| $50,197 – $81,411 | 29.65% |

| $81,411 – $92,454 | 31.48% |

| 92,454 – $95,906 | 33.89% |

| $95,906 – $100,392 | 37.91% |

| $100,392 – $150,000 | 43.41% |

| $150,000 – $155,625 | 44.97% |

| $155,625 – $220,000 | 48.35% |

| $220,000 – $221,708 | 49.91% |

| over $221,708 | 53.35% |

I have simplified the above chart to summarize all major marginal tax rates. However, there are additional income ranges and marginal tax rates.

The best way to explain this system is to use an example.

In this example, we’ll assume a real estate investor earns employment income of $150,000. To calculate the tax payable, we have to go through the entire list of marginal tax rates.

Here’s how it works:

Between $0 and $11,141, you get taxed nothing.

Between $11,141 and $14,398, you get taxed at 5.05% Ontario tax rate.

= ($14,398 – $11,141) x 5.05% = $164.48.

Between $14,398 and $46,226 you get taxed at 20.05%.

=($46,226 – $14,398) x 20.05% = $6,381.5.

And so on. We have to go through the above calculation for someone who earns $150K employment income. Then, add them all up in the tax payable column, and we will come up with a total tax payable of $44,642.

See the table below:

How does Tax Deduction Work?

Now that you get a better understanding of how the Canadian personal tax system works.

We can explain how tax deduction works.

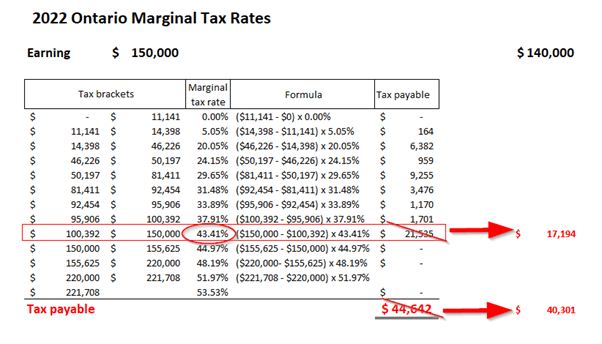

Tax deduction is used to reduce your tax income. For someone who’s earning $150,000 in his personal tax return, having an extra $10,000 deduction means that he only pays tax on $140K.

The $10,000 deduction means that he can save $10,000 x the highest marginal tax rate he belongs to, and in this case, it is 43.41%.

Tax savings = $10,000 x 43.41% = $4,341

Total tax liability is $40,301, instead of $44,642.

As you can see, a tax deduction is used to shave off the taxable income from the top marginal tax rate.

The higher your income, the higher your marginal tax rate would be, and the higher the saving extra tax deduction would give you.

Common tax deductions:

Now another thing that t

First of all, as real estate investors, the biggest tax deductions we get to apply are the ones we discussed in the past blog post – top 10 tax deductions real estate investors can make in this blog post.

We also discussed how you could deduct moving expenses and deduct travel expenses here before.

Another commonly used one is child care expense deduction. Rules surrounding child care expense deduction are a bit more complicated. But similar to all other tax deductions, child care expense deduction is deducted against the top marginal tax rate of the lower income spouse, up to a maximum based on the age of the kids.

As a real estate investor, you’re probably already familiar with Registered Retirement Savings Plan (RRSP) Deduction as one of the best tax-saving strategies in Canada.

Another commonly used one for investors is interest expense deduction. If you borrow money to invest, the interest expense you incurred for the purpose of earning investment income is generally deductible as a tax deduction.

These are common tax deductions that shave the income tax off the top marginal tax rate, giving you most tax benefits.

What is a Tax Credit?

The CRA defines Tax Credit as an amount that reduces the tax you pay on your taxable income. The more tax credits that apply to you, the more you can reduce your income tax.

The federal, provincial and territorial governments each provide tax credits, which you can use to lower your taxes.

Unlike tax deduction, tax credits are given to you using the lowest marginal tax rates – rather than the highest.

If you get a $10,000 tax credit and assuming the tax credits are offered by both the Federal and provincial government, the tax credits are usually calculated using the lowest marginal tax rate and in our example below, it is 20.05% combined. Federal lowest marginal tax rate is 15% and Ontario lowest marginal tax rate is 5.05%.

So a $10,000 tax credit is equivalent to a tax saving of $10,000 x 20.05% = $2,005.

If you compare the tax saving from a $10,000 tax credit to a $10,000 tax deduction, you can see that tax saving from a $10,000 tax credit would only give you $2,005 tax saving, whereas a $10,000 tax deduction would give you $4,341 tax saving for someone earning $150,000.

Tax credit gives you tax savings calculated based on the LOWEST marginal tax rates.

Tax deduction gives you tax savings calculated based on the HIGHEST marginal tax rates.

Commons Tax Credits

Refundable vs. Non-refundable Tax Credits

Tax credits are not always equal either. Some tax credits are refundable, some aren’t.

As an example, the first time home buyer tax credit is a non-refundable tax credit. It can be used to reduce your tax payable. But if you do not have a tax payable, then you’re not entitled to a refund.

Similarly, medical expenses, tuition, donation, disability, digital news subscription, interest on student loans are examples of non-refundable tax credits. They are all used to offset against your tax payable. If you have more non-refundable tax credits than your tax payable, then no refund would be issued. The excess tax credit is then unused.

On the other hand, a refundable tax credit, such as the Working Income Tax credit, are credits that will be paid to you whether or not you have paid taxes. Ontario Energy and Property Tax credit is a commonly known refundable tax credit that’s available to taxpayers that qualify.

Would You Always Get a Refund?

The First-time Home Buyer Incentive is an incentive provided by the federal government with the help of CMHC, w

For tax deduction, you won’t always get a refund. You will only get a refund if your tax payable, after taking the tax deduction, is greater than what you have paid to CRA.

I had a couple of clients who are brand new real estate investors who quit their jobs and doing real estate investing full-time, they spent a lot of money and effort on renovating their properties. When the tax time comes, they are expecting a huge amount of tax refund.

First of all, major renovation is rarely considered a tax deduction.

Secondly, even with legitimate tax deduction, if they had never paid any taxes to begin with,

Since they were brand new investors, not earning income to begin with, there were no taxes paid.

Difference between Federal and Provincial Tax Credits

Some tax credits are available federally while some are available provincially.

As an example, Ontario Energy and Property Tax Credit and Staycation Tax Credit are available strictly in Ontario only. The calculation is based on the qualification criteria as set out by the Ontario government.

Some tax credits, such as tuition tax credit as well as digital news subscription expenses tax credit are available Federally. The tax benefit is calculated based on the lowest marginal tax rate imposed by the Federal government at 15%, not the combined tax rate of 20.05%.

Now that you have got a firm understanding of the differences between a tax deduction and tax credit. It’s almost safe to say that if you’re making money and paying taxes, it’s always better to get tax deductions, rather than tax credits.

There’re ways to convert some tax credits into tax deductions for business owners. Stayed tuned for another post.

Until next time, Happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant