The Canada Pension Plan (CPP), a cornerstone of retirement savings for working Canadians, is undergoing significant changes in 2024. In this blog post, we’ll explore these changes in detail, including the new tier system, contribution calculations, and strategies for maximizing your retirement savings, especially for those in the real estate sector.

Understanding the Canada Pension Plan (CPP):

The Canada Pension Plan (CPP) is a mandatory federal retirement savings plan for Canadians. Contributions are deducted from paychecks, ensuring that every working Canadian contributes to their future financial stability. However, the CPP is more than just a deduction from your paycheck; it represents the government’s strategy to ensure Canadians have a financial safety net in retirement.

Canada Pension Plan (CPP) Changes in 2024:

Starting January 1, 2024, the CPP will see a major overhaul with the introduction of a tier system. These are in addition to the base CPP and the first additional CPP contributions. This change is aimed at adjusting the plan to better reflect the evolving economic landscape and provide more robust retirement savings.

What are the first and second earnings ceilings?

The first earnings ceiling is the eligible income on which you make CPP contributions. It is formally known as the year’s maximum pensionable earnings, or YMPE. The first earnings ceiling, or YMPE, will be $68,500 in 2024.

In 2024, the second earnings ceiling, known as the year’s additional maximum pensionable earnings, or YAMPE, will be introduced. The amount of the second earnings ceiling is based on the amount of the first earnings ceiling.

The amount of the second earnings ceiling is:

- approximately 7% higher than the first earnings ceiling in 2024

- approximately 14% higher than the first earnings ceiling in 2025 and following years

In 2024, the second earnings ceiling will be $73,200.

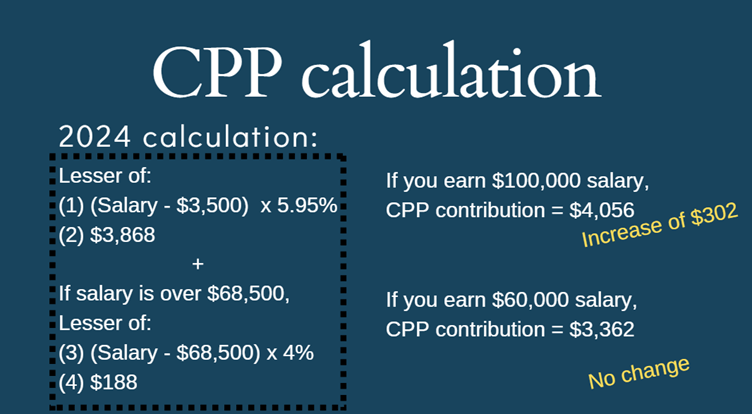

Contribution Calculations for 2023 and 2024:

- 2023: The CPP contribution is calculated by multiplying the maximum pensionable earnings ($66,600) by the CPP rate (5.95%), minus the basic exemption ($3,500). This results in a maximum contribution of $3,754. For some one who is earning below the maximum pensionable earning ($60,000), your 2023 CPP contribution would be $3,362.

- 2024: The new tier system kicks in. For earnings up to $68,500, the contribution calculation remains similar. However, for earnings between $68,500 and $73,200, an additional 4% rate is applied to the $4,700 Delta.

Impact on Different Salary Ranges:

- Salaries above $73,200: These fall into the second tier, with a maximum additional contribution of $4055.50.

- Salaries below $68,500: The contribution remains the same at $3,362.

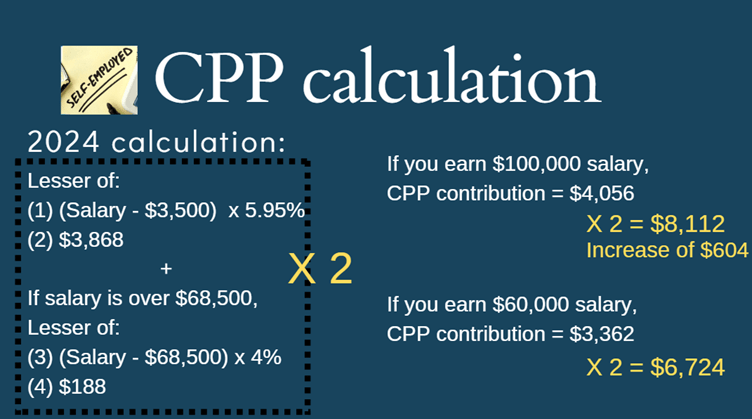

Let me share an example that might make it simpler. For instance, with a salary of $100,000 in 2023, the contribution is $3,754. In 2024, the calculation includes the base amount and additional earnings, resulting in a $302 increase. Please see the calculation below:

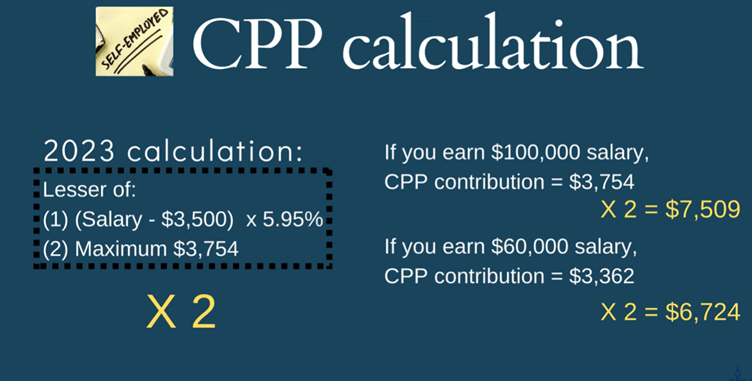

Self-Employed Individuals:

Self-employed Canadians face a unique situation as they contribute twice, both the employee and employer portions of the CPP. This results in higher contributions compared to employed individuals.. Please see the calculation below if you are a self-employed individual earning $60,000 or $100,000.

Owning a Business in a Corporation:

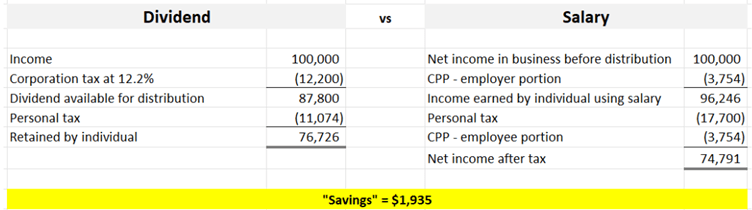

Business owners, particularly those with corporations, face a crucial decision: paying themselves a salary or dividends. While a salary involves CPP contributions (thus increasing costs), dividends can offer tax savings by incurring lower corporation and personal taxes.

Salary vs. Dividend – Tax Savings

If your business has $100,000 to distribute, paying yourself a salary could save you $1,935 compared to dividends, considering the matching CPP contributions and tax implications.

Investing CPP Contributions:

An essential consideration is whether to rely on the government-managed CPP for retirement savings or to take a more active role in personal retirement planning. For those earning above the maximum pensionable earnings, investing in a personal retirement plan could be more lucrative than relying solely on the CPP.

The 2024 changes to the Canada Pension Plan represent a significant shift in how Canadians will save for retirement. By staying informed and strategically planning your salary and investment choices, you can maximize your retirement savings and secure your financial future. If you would like to know more about CPP in detail, watch the video i filmed recently.

Cherry Chan, CPA, CA

Your Real Estate Tax Accountant