Our lease on our Honda Odyssey was ending coming October.

One of our friends got a plug-in hybrid earlier this year. This plug-in hybrid is considered a “green vehicle” which would allow him to drive on HOV lane on 400 series highway.

For those of you who don’t know HOV lane – it stands for high occupancy vehicle lanes. You can go in this lane if you have 2 or more passengers OR you have a green vehicle.

Green vehicles include the plug-in hybrid. Green vehicles also include this Chrysler Pacifica. ?

We are excited to save us time (even though our commute time to the office and gym is relatively smooth)!

Erwin and I both knew that we would want another mini-van for ease of transportation. We have two kids, a nanny (and her family) who live with us, my mother in law who comes over to visit for half a year.

Looking through the options available, Chrysler Pacifica was the only one available.

We have heard a few stories about the maintenance issues with Chrysler. Our family members also shared their less than stellar experience with Chrysler. We knew that we would opt to lease the vehicle if we were to go with Pacifica.

Erwin and I really wanted to make this work, despite the negative family opinion on the vehicle. We consulted with everyone who could think of!

We talked to Mike LaMarsh, our client who used to be a mechanic at Canadian Tire, now a full-time real estate investor.

We talked to my father-in-law’s high school friend, who oversees a company that owns multiple dealerships, including both Honda & Chrysler.

He speaks highly of Chrysler Pacifica.

But when it comes down to the lease terms, Honda Odyssey offers much better deals.

The better interest rate on lease and higher buyout price at the end of the term which means lower monthly lease payments, and let’s not even get started on the car insurance quotes between the two!

Even with the provincial green car rebate for $14K on Chrysler Pacifica, we are still talking about a $100 increase in monthly lease payment if we were to go with Pacifica Hybrid.

A $4,800 that I would rather keep it in my pocket than paying toward my car. ?

You may wonder why I opt for leasing, instead of buying. Are there tax advantages choosing one over another?

The answer is – it depends.

Every deal is different

We know from all the car dealership advertisements that they offer different pricing if you pay cash to buy the vehicle right away. The cash incentive can be more if you buy during the promotional period, whereas the incentive can be smaller in the spring market. Purchasing any vehicle is a big investment and you want to make sure you are doing this correctly.

You would get a separate set of pricing and rates if you were get it on finance. The pricing is generally higher than buying out right.

You can also choose to buy the car with your line of credit, which is yet another set of calculation.

Then you get another set of pricing and rates if you were to lease the vehicle. When you lease, the calculation can be drastically different on a high mileage lease vs a low one.

The buyback value at the end of the lease term can affect the monthly calculation (like my situation above comparing Pacifica vs. Odyssey).

So next time when you ask your accountant, “should I buy?, or should I lease?”, you can see how complicated it is to come up with an answer.

It’s not an easy calculation to see which one will provide a better deal at the end of the day.

What if they were the same deal?

Can they really be the same deal? I don’t think so. It’s for complications like these that lead many people to taking out a car loan to obtain a new vehicle. That way, you can use an auto payment calculator to work out exactly how much needs to be paid back, making the financial process simple to follow.

But let’s try our best to keep as much as the variable the same to do some high-level analysis on my Honda.

The purchase price is roughly $38K plus HST.

What are the tax deductions if you buy the car?

Income Tax Act allows you to claim up to $30K plus HST on passenger vehicle purchased.

You can spend over $100K on Tesla’s Model S, but you get to claim only $30K plus HST.

There is a CAP on what you can claim.

This vehicle belongs to class 10.1 and 30% depreciation rate can be applied to the purchase cost (maximum $30K plus HST) or undepreciated balance annually.

Let’s assume that you use the vehicle 100% business use for simplicity. (Generally speaking, you need a logbook to document your business use mileage to prorate for business use, you can find out more about the documentation required from this previous blog post ).

So,

Year 1 – you can get a deduction of $30K x 1.13 x 30% x ½ = $5,085

Year 2 – you get a full deduction of ($33,900 – $5,085) x 30% = $8,645

Year 3 – deduction is calculated on the undepreciated amount ($33,900 – $5,085 – $8,645) x 30% = $6,054

Year 4 – $ 4,236

How much can I deduct now that I am leasing:

When you are leasing a vehicle, CRA also imposes a cap on the maximum amount of monthly lease payment you can deduct. Currently, that is $800 plus HST.

Just because your lease is less than $800, it does not mean that you can get the full deduction. You have to go through a complicated calculation to calculate the true maximum you can claim.

Here’s the link to the calculation

My monthly lease payment is $592.50 taxes included.

Keep in mind interest rate is 4.99% on the lease and I have a high buyback value of $19,500.

Year 1 deduction (assume only 6 months similar to the case above) – $3,555

Year 2 deduction $592.50 x 12 months = $7,110

Year 3 deduction $7,110

Year 4 deduction $7,110

Year 5 deduction $3,555 (last year of the lease) and you likely will lease another vehicle or buy out the current car or get a different car.

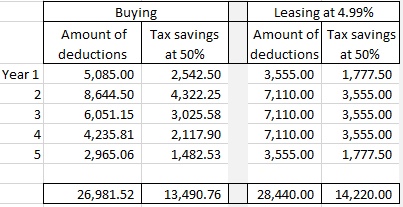

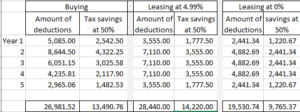

The chart below summarizes the buying vs leasing deductions, and it’s tax savings (if your rate is at 50%).

You may think it is more beneficial to lease, but…

Don’t forget that I pay 4.99% interest on my lease – which is translated to $5,638 for the entire term for 4 years.

You wouldn’t have this cost incurred if you were buying it outright.

What if it is zero % interest rate?

Yep – buying gives a slight edge in my Honda Odyssey calculation.

If the lease rate is 0% which will not happen, you will have a tax saving of $9,765, less beneficial than buying. (See chart below)

From the math analytics above, buying allows you to deduct more at the beginning, whereas lease deduction is smooth out over time.

It’s hard to come up with a pure apple to apple comparison given that interest rate and buyback value have a significant impact on the calculation.

Other considerations

- What if you are a realtor driving your car from Barrie to St Catharine’s multiple times a week? You will have high mileage on the vehicle which generally is not suitable for leasing.

- What if you know that the cost of maintenance is high, but you still want to drive the car when it’s new?

Erwin’s European car is well known to have high maintenance cost around the expiry of manufacturer warranty. He loves the car, but he doesn’t want to keep it long term, better lease it and not to worry about the long-term maintenance cost. - You can sell the car at the end if you don’t like, but you can’t sell a leased vehicle.

- Do you own your business in personal name or corporation? If you own your business in a corporation, driving an old car would still allow you the same mileage deduction at $0.55/km for the first 5,000km and $0.49/km thereafter.

If you don’t need to incur the cost to buy a new car, why bother?

Now we have had our new Odyssey for over a week. We enjoy the new technology and features that it offers.

For those who are geeky like me, it now offers a new feature when your car is on cruise control. When the car senses that there’s another car at a lower speed in front of you, even though your cruise control is pre-set at 100km, it automatically adjusts the speed and slows down for you.

If you switch to an open lane, the car speeds up again to your pre-set speed.

Cool, isn’t it?

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Terry

Buying $5,085 deduction’s 50% tax saving seems to be $2,542, not $1,017.

Cherry Chan

Thanks Terry. I will have my website girl fix it in the next hour or so.