Working from home has become increasingly common, and for many Canadians, it’s here to stay. But what about claiming home office expenses on your taxes? The rules have changed.

This blog post and my latest video on YouTube breaks down everything you need to know about claiming home office expenses in Canada.

The Shift in Deduction Criteria

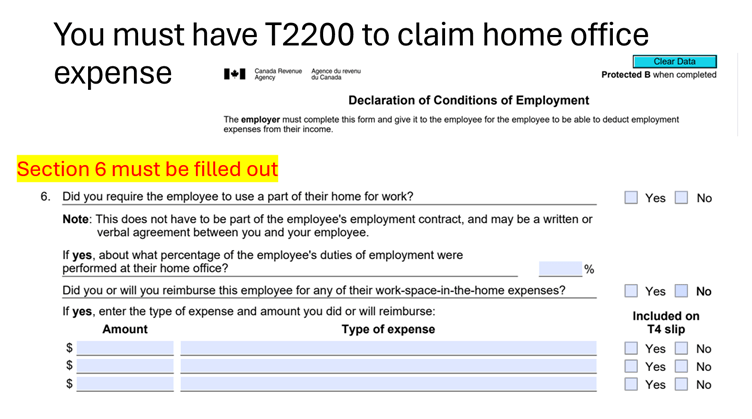

For the past two years, the government permitted the deduction of home office expenses without extensive documentation. However, starting in 2023, a significant change requires employees to obtain a T2200 form—Declaration of Conditions of Employment—from their employers to qualify for these deductions.

Understanding the T2200 Form

Background of T2200 in Pre-COVID Times: Before the world was upended by COVID-19, Form T2200 was the essential document for employees. The T2200 form is an employer’s declaration that verifies an employee’s need to work from home, making it the cornerstone of claiming home office deductions. Without this form, employees cannot substantiate their claims for workspace expenses incurred from remote work.

Impact of COVID-19 on Work Arrangements and Expense Claims: Come 2020, the landscape changed drastically. Offices closed, and home offices became the new normal, significantly impacting remote work practices in not-for-profit organizations and associations. Recognizing this shift, the government introduced a temporary measure that allowed taxpayers to claim up to $400 in home office expenses on their tax returns without needing a T2200.

Changes in 2023/2024: Now, in 2023, we witnessed another shift. The convenient $400 home office expense deduction is no longer available, bringing back the pre-pandemic rules. The T2200 is back in the spotlight

T2200 form link on CRA’s website is as below:

https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2200.html

Eligibility for Home Office Expense Deductions: Who Qualifies?

An employee can claim home office expense deduction in 2023 provided that they meet the following criteria:

- You must be “required” to work from home. You must have an agreement with your employer to work from home. The agreement does not have to be a written agreement. Verbal agreement is acceptable.

- You must pay for expenses related to your work space at your home.

- You must work at least 50% of the time for a period of at least 4 consecutive weeks in the year. Say if you go to your office two times a week, and work from home 3 days a week, you’re working from home 60% of the time. Therefore, you would meet this eligibility requirement.

- You must receive a completed and signed Form T2200 from your employer.

What if you voluntarily work from home?

If you voluntarily choose to work-from-home, CRA will consider the employee to meet the “required to work from home” criteria stated above. This means that if you choose to work from home, you are still eligible to claim your work from home expenses, provided that you meet all the other criteria above.

Deductible Expenses

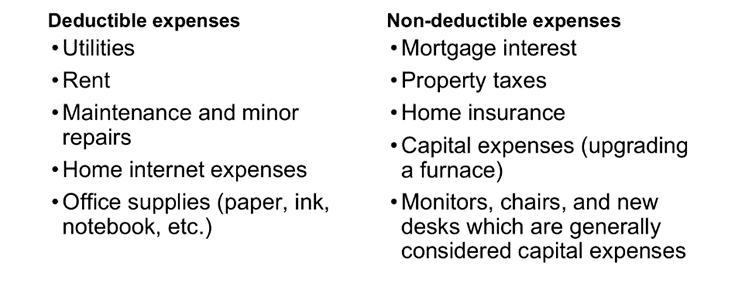

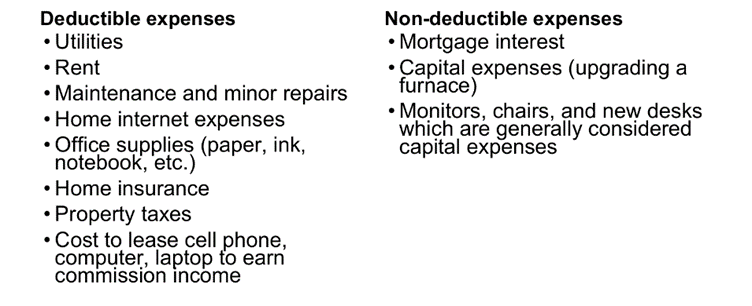

The nature of your employment (salary versus commission-based) influences the types of expenses you can claim. While both can deduct utilities, rent, maintenance, repairs, and home internet expenses, commission-based employees may also deduct home insurance, property taxes, and certain equipment leases. I have listed the deductible expenses in the images below for your reference

For Salaried Employees with no Commission:

For Commission Based Employees:

As a commission based employee, you are eligible to claim more expenses. Unfortunately, the biggest expense – mortgage interest is still non-deductible.

Documentation is Key: Keeping Your Records Straight

The CRA might come knocking, so it’s crucial to maintain proper documentation for several years. Here’s what you’ll need:

- Floor plan: A copy of your floor plan with the designated home office space clearly marked.

- Receipts: Keep receipts for all claimed expenses, including utilities, maintenance, internet, property tax (if applicable), insurance (if applicable), and other relevant costs.

- Shared Workspace Log: If you share your workspace (like a kitchen table) for both work and personal use, maintain a log detailing the hours you use it specifically for work purposes.

These records substantiate the expenses claimed on the T777 form, crucial for accurate tax filing.

T777 form link on CRA’s website is as below:

https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t777.html

Conclusion

As remote work continues to be a significant aspect of many Canadians’ employment, understanding and adapting to the updated requirements is vital to maximize home office deductions the right way.

Until next time,

Cherry Chan, CPA, CA

Your Real Estate Tax Accountant