The Canadian government introduced Tax-Free Saving Accounts (“TFSA”) back in 2019. The goal of TFSA is to encourage Canadians to save for retirement.

TFSA contribution you make as a taxpayer isn’t tax deductible, unlike the traditional Registered Retirement Saving Plans (“RRSP”).

But the withdrawal isn’t taxable either.

Canada Revenue Agency sets out an annual contribution limit to TFSA. It started off rather small, a $5,000 contribution limit was imposed in 2019.

If you don’t make contribution to your TFSA, the unused contribution limit can be carried forward to the following year.

Investment income you earn within your TFSA can grow in a tax-free environment. Withdrawal from TFSA is also generally tax-free.

Amount you withdraw from current year is added back to your unused contribution room for the following year to allow you to “roll your contribution room” further.

If you were over the age of 18 in 2019 and you had never contributed to your TFSA ever, you would have accumulated $88,000 of contribution room.

It can mean that you can potentially save thousands of dollars of taxes if you invest within your TFSA.

Sounds like a good deal, isn’t it?

Well, that’s exactly what the taxpayer who’s ruled to be liable for $600K taxes and penalty thought (Ahamed v. The King, 2023 TCC).

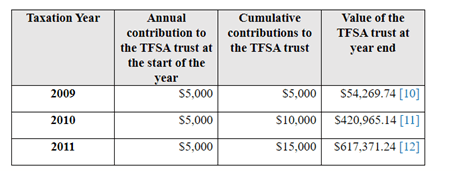

The taxpayer, Mr. Ahamed, capitalized the TFSA trust by making a maximum amount of contribution of $5,000 in 2009, 2010 and 2011. The value of the TFSA balance is illustrated below:

At the end of 2012, the balance of Mr. Ahamed’s account was $564,482.90. He sold its securities and withdrew $547,788.83 from his TFSA.

Are you surprised by how much Mr. Ahamed made between 2009 to 2012 with as little as $15K of investments?

It’s not a surprise that CRA decided to reassess the “tax-free status” of this gain, arguing on the basis that Mr. Ahmed carried on a business of trading investments in each of the year.

The Income Tax Act does not allow taxpayers to carry on a business in their TFSA. You can invest to earn, but you can’t carry on a business in your TFSA.

The Minister reassessed Part I tax to Mr. Ahamed, total of $569,481.

You may wonder – what is considered “carrying on a business” in your TFSA?

Like everything else in the Income Tax Act, it isn’t a black and white answer.

Similar to determining whether you are flipping a property or holding it for long-term capital investment, previous court cases have established the following set of guidelines to determine if the trading behaviour is considered “carrying on a business” or investing in long-term capital investment.

Here’re the list of criteria –

“Carrying on a business” (not allowed in TFSA) vs. Long-term Capital Investment (qualified for TFSA tax free status)

(a) frequency of transactions – a history of extensive buying and selling of securities or of a quick turnover of properties,

The more your trade, the more likely you are considered carrying on a business. If you are in it for long-term investments earning dividends and hoping for capital appreciation, you’re more likely to hold your securities long-term.

(b) period of ownership – securities are usually owned only for a short period of time,

Similar to criteria (a) above, the longer you own the securities, the less likely you’re considered carrying on a business or day trading. If you are investing it for long-term, you are more likely to hold it for a longer period of time.

(c) knowledge of securities markets – the taxpayer has some knowledge of or experience in the securities markets,

If you are involved in securities trading in your day job, or if you have professional qualification for trading, CRA would consider the trading more as “carrying on a business” and “day trading”.

(d) security transactions form a part of a taxpayer’s ordinary business,

If you already have a business trading securities, it’s more likely that your trading activities inside your TFSA are considered “carrying on a business”. On the other hand, you might be a plumber by trade. Your business has nothing to do with day trading or carrying on a business as trading. Chances are, it’s less likely CRA would consider your trading behaviour inside your TFSA as “carrying on a business”.

(e) time spent – a substantial part of the taxpayer’s time is spent studying the securities markets and investigating potential purchases,

How often do you spend on studying the market also makes a difference when it comes down to determining your trading transactions in your TFSA. The more time you spent on studying the market and exploring potential purchase opportunities, the more likely you’re considered “day trading” or “carrying on a business” in your TFSA.

(f) financing – security purchases are financed primarily on margin or by some other form of debt,

Generally speaking, you’re not allowed to use margin accounts or borrowed funds within your TFSA. This criterion would not be applicable for TFSA trading transactions.

(g) advertising – the taxpayer has advertised or otherwise made it known that he is willing to purchase securities, and

(h) in the case of shares, their nature – normally speculative in nature or of a non-dividend type.

This one is straight-forward. If you are investing in stocks that generate dividend yield, you are more likely considered investing for the long-term. If you are buying stocks that do NOT generate dividend yield, CRA would assume that you are in it for a quick upside, which in itself, could be considered as carrying on a business of trading.

As you can tell, it isn’t black and white.

These same set of criteria are used to evaluate trading transactions outside of registered accounts. If one is deemed to be “carrying on a business” in trading, or day trader, 100% of the gain is reported as business income. 100% of the profit is taxable.

On the flip side, if the trading behaviour is concluded to be on account of capital (long-term investments), the gain you make would be considered as capital gain. Only 50% of the gain is taxable.

If you incur a loss from your trading and you’re day trading, your loss can be used to offset against other sources of income.

On the other hand, if you are trading on account of capital (long-term investment), the loss you incur would be considered capital loss. You can only offset capital loss against capital gain.

As you can imagine, when you incur a gain, most taxpayers prefer a capital gain treatment (only 50% taxable). When you incur a loss, most taxpayers prefer business loss treatment (100% offset against all other sources of income).

CRA has the opposite view and they use precisely the same criteria to support their own argument.

In this particular case, Mr. Ahmed recognized that CRA had an upper hand arguing against CRA using the above criteria.

Yes – he’s deemed to be trading securities as a business inside a TFSA. His stock investments were mostly non-dividend paying stock, he transacted on them frequently and many stocks that he transacted on were penny stocks of nominal value and he held them for very short period.

He doesn’t stand a chance if CRA and the court used the criteria that they have always been using to evaluate trading behavior outside of registered accounts.

Instead, he decided to argue that the legislative intent of TFSA was to allow Canadian taxpayers to trade and make a profit. The lawyer argued that:

- RRSP allows for trading as a business but growth in RRSP remains exempt. TFSA should not be any different. (And yes, you’re allowed to trade like a pro in your RRSP, but withdrawal of RRSP is taxable, but withdrawal from TFSA isn’t. Guess that’s why CRA doesn’t really care that you carry on a business of trading in RRSP because they will be taxing 100% of your withdrawal anyway – even if you are trading on account of capital).

- The traditional test (discussed above) was not constructed with a view to non-taxable entities like TFSA. The taxpayer and his lawyer argued that the tax-free nature of TFSA would encourage taxpayers to take higher risk, transact more frequently and hold on to the underlying securities for a shorter period – and if you use the existing criteria, taxpayers would always be treated as carrying on a business in TFSA. The taxpayer and his lawyer even proposed some new criteria to the court for analysis.

- Prior court case concluded that trading within RRSP does not constitute carrying on a business of trading. The same rationale should be extended to the TFSA context.

I applaud the creativity and courage this taxpayer and his legal team had in terms of arguing with CRA court. As Canadian taxpayers, we need more people stepping forward to argue in different context.

Unfortunately, the taxpayer lost and is still liable for his $600K tax bill.

For now, until we have another taxpayer willing to step up and fight CRA again, don’t do day trading in your TFSA.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant