It is almost end of the tax season. We see cherry blossoms everywhere. Weather is warming up and I hope you guys got to enjoy some sunshine these days.

It feels like it’s the nature’s way to tell us to get out of this pandemic and get back to our normal lives slowly.

Businesses are starting to open slowly. Schools are cancelled for the rest of the school year.

It’s always interesting to watch how these pandemic policies unfold in different part of the world.

Back home, my mom’s drapery store never got shut down. My dad’s contracting business never stops operating. I frequently see chats about eating out in our family chat group.

Schools back in Hong Kong are also opening up this week.

Everyone is still wearing masks. In fact, if you don’t wear a mask in Hong Kong, you’re not even allowed on the public transit system. People judge you if you don’t have one.

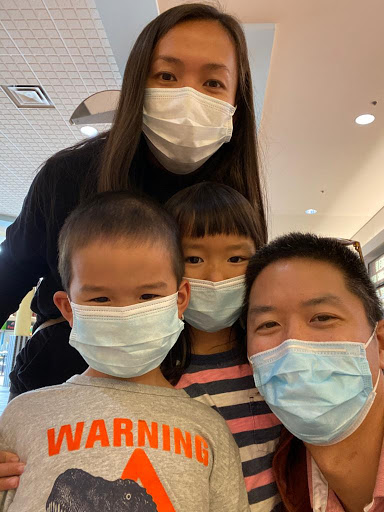

I’m not qualified to say whether wearing masks are useful or not, but we did “masked up” when we visited the grocery stores and food court – to protect ourselves and to protect others. 😊

Kids don’t know the difference but they’re just excited to try on something new.

Speaking of kids, did you know that the COVID-19 additional childcare benefit $300 per child has been deposited to your bank account this week?

It was nice to check my bank account to receive an additional $600 benefit from the government.

In addition to this nice surprise in my bank account, Prime Minister Justin Trudeau also announced expansion of the Canada Emergency Business Account qualification criteria on Tuesday.

Canada Emergency Business Account (CEBA) qualification criteria expanded

Background:

- As a refresher, CEBA loan is the $40K interest free loan that the government offers to small businesses, provided that it is repaid before end of 2022.

- If you repay by Dec 31, 2022, it is not only interest free, $10K of the loan will be waived.

- When it was first came out, small businesses would be required to have a payroll of $50K in 2019 to qualify to apply. The payroll requirement was subsequently lowered to $20K in 2019.

- You would still be required to have a business bank account, not a personal bank account, to apply. The loans are only available for application via the big banks’ system. If you don’t have a business bank accounts, you are not able to access the application page.

- Many real estate agents and business owners who use primarily subcontractors and pay themselves via dividends did not qualify.

- Some real estate agents who have sufficient payroll but used personal chequing account aren’t able to access this loan.

Expanded criteria announced by Prime Minister Justin Trudeau on May 19, 2020 Tuesday:

- You’re still required to have a business operating account at a participating financial institution

- A Canada Revenue Agency business number, and to have filed 2018 or 2019 tax return

- Eligible non-deferrable expenses between $40,000 and $1.5million. Eligible non-deferrable expenses could include costs such as rent, property taxes, utilities and insurance.

Potential impact on real estate investors who own your real estate properties in the corporation:

- If you have a corporation, you would have a Canada Revenue Agency Business Number.

- If you have non-deferrable expenses between $40K and $1.5million, chances are, you would be qualified to apply for this $40K loan under the newly expanded criteria.

- Non-deferrable expenses would include your property taxes, utilities and insurance. I would include property management fees as the non-deferrable expenses as well.

- This means that – if your real estate corporation has non-deferrable expenses totalling over $40K, you could be qualified for this $40K loan!

- We’re still waiting for official update on the CEBA loan website. Stay tuned and we would keep you up to date.

- If you’re real estate investors that do not own properties in a corporation, you would not have a business number with CRA, therefore, you won’t qualify for the loan under the expanded criteria. Sorry. ☹

Potential impact on real estate agents/realtors/brokerages:

- Many real estate agents and self-employed individuals did not qualify to apply for this loan before because they do not have any payroll and they heavily leverage subcontractors instead.

- Prime Minister Justin Trudeau acknowledged that their programs haven’t reached this group of small business owners.

- With the expanded criteria, now real estate agents and self-employed individuals can apply for this loan, provided that you have a business number with CRA and $40K of non-deferrable expenses.

- You should be able to use your HST registration number as your business number – pending government’s official announcement. All realtors I know have a HST registration number. Many small business owners that are self employed that could also register.

- In terms of the $40K non-deferrable expenses, common expenses include desk fees, insurance such as RECO insurance, board membership fees, rent if you rent an office, cell phone bills, website subscription service, etc.

- Again, we’re waiting for further clarification from the government on what this $40K means and will share with you any future update.

- If you do not have HST registration number, you likely cannot qualify for the loan under the expanded criteria.

- If you do not have a business bank account, as most self-employed sole proprietors do not, the government is working on having a workaround for you. Prime Minister Justin Trudeau acknowledged that there’s a short coming in the current program and they are working on addressing it.

There’s still a lot of confusion in the program and we’re waiting anxiously for more clarification!

Will keep everyone up to date over the next few days!

Until next time, enjoy the nice weather.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Rupi

Hi, I have an incorporation for which I have a business account. I also have a sole proprietorship But there is no separate business account for that, I use my chequing account for that. I have non deferred expenses for my sole proprietorship but not for my incorporation . Can I still use my business account to apply for the loan ?

Cherry Chan

Unfortunately, you cannot use a different business bank account of the corporation to apply for a personally owned business.

The government is working on a workaround for people who do not have the business bank account. Stay tuned.

Dave

Anyone can apply and wait for the bank decision. Banks are willing to lend as gov. Protecting such debts

Fabian

What if your no deferral expenses for 2018 and 2019 combined were 40k

Cherry Chan

It has to be $40K for 2020

Adi

Hi,to avail the $40k loan, do you need to have a set number of employees working for you?

Case in point- If i have a company incorporated and profession is a truck driver, and i get salary from the company- can i apply for the loan?

Cherry Chan

Payroll expenses must be over $20K in 2019 to qualify.

Otherwise, all you need is $40K of non-deferrable expenses in 2020

Ken

Hello, let us know when the government accepts applicants for sole proprietorship bank accounts. I have a few associates that are in that predicament.

Thanks.

Cherry Chan

Not yet, not yet. 🙁

Demetre K

Hi,

What can be done for your local realtor?

We still have all our expenses and fees for our license to pay and have seen a dip is transactions.

Are we covered? We are issued T4A into our personal bank accounts. Personally my expenses are not $40,000 a year but a loan to umbrella our business and push us along would be great as we didn’t qualify for cerb or CEBA.

Looking forward to your updates! Very well written.

Thanks!

Anu

In the same boat as you here.

@Cherry would appreciate some insight as to what the situation might be for Realtors whose expenses are just under 40k but operating through a personal account (that’s where my commissions get paid into). Was there any further government clarification/update after the date of this article?

Thanks in advance. Your articles are very helpful.

Cherry Chan

Sorry for the bearer of the bad news, there’s very limited resources available to help you if your expenses are under $40K in 2020.

Hopefully the market has picked up enough for your clients and you to take advantage of.

Sia

Hi

I called the cerb phone line to ask them of real estate agents are eligible to apply for cerb or not and what they told me that there is no change and we still cant apply. Please advise

Cherry Chan

Hi Sia, unfortunately I don’t have a crystal ball.

Technically many real estate agents would qualify, it’s just most real estate agents do not have a business bank account which is what the government uses to identify that you have a qualified business.

Justin Trudeau came out in May saying that they recognized the short coming in the current process and will address it. He also said the same thing again end of August.

We don’t have a crystal ball when the government will come out with their revised procedures. All we can do is to wait.