What are the biggest tax changes in Canada in 2024, and how will they affect you?

This blog post will provide an overview of the upcoming Tax Changes in 2024. I’ll simplify the key updates that will impact your finances, ensuring you’re well-informed for the year ahead.

1. Marginal Tax Rate

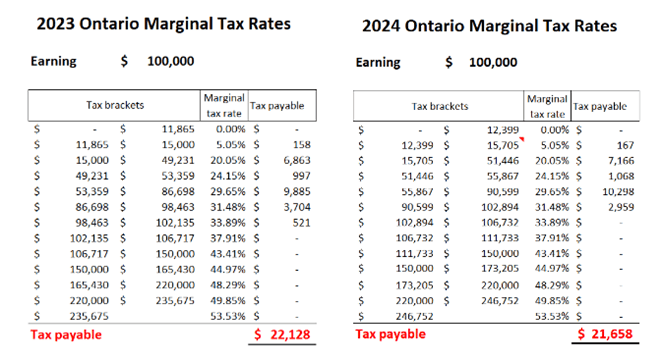

In Canada, our personal tax system follows a progressive model, meaning that as your income increases, your tax obligation also rises. The marginal tax rates for personal income in Ontario have been adjusted to reflect inflation, resulting in reduced tax payable for some individuals

Here’s how it works:

For someone earning $100,000 in 2023 in Ontario, the estimated tax payable is about $22,128. These tax brackets are adjusted annually by the Canadian government to account for inflation. In 2024, the tax brackets have been adjusted, and someone with a $100,000 income would pay $21,658 in taxes, compared to $22,128 in 2023.

This reflects a slight decrease in annual tax payable due to changes in the tax brackets from year to year.

2. Canadian Pension Plan

You can refer back to my recent video that I did on CPP changes for 2024.

3. RRSP contribution

The contribution limit is $31,560 – which is $175,333 annual salary. You have until February 29, 2024 to make your contribution. RRSP contribution is deductible against income, which means you get to save taxes.

4. Tax Free Saving Accounts (TFSA)

The contribution limit for 2024 has been increased to $7,000. If you have never contributed since 2009, the inception of the TFSA plan, and assuming that you qualify to contribute since 2009, you would have a cumulative contribution room of $95,000.

Cumulative contribution amount of $95,000 is a substantial amount of investment. If you are wondering where you should invest, TFSA is usually the first account that I would use to invest to avoid most taxes. If you were to invest the entire $95K in something that gives you 10% return, you can earn $9,500 tax-free. As we discussed previously, in Ontario, you can pay as much as 53.5% income tax on any income earned personally. On a $9,500 income, you can save as much as $5,100 of taxes.

If you were younger than 18 in 2009 or if you were not here in Canada as a tax resident at that time, your cumulative contribution limit can be lowered. If you’ve already contributed and withdrawn money from your TFSA, it’s best you check with your CRA record before you make further contributions.

5. Canada Dental Care Plan Benefit (CDCP)

Additionally, the Canadian Dental Care Plan will be updated in 2024, with coverage for people with household income under $90,000, provided they are not already insured as well as those that don’t have insurance coverage through their employers .

To qualify for the CDCP, you must:

- Not have access to dental insurance:

- Not having access to dental insurance is defined as:

- no dental insurance through your employer or a family member’s employer benefits, including health and wellness accounts;

- no dental insurance through your pension (previous employer) or a family member’s pension benefits; or

- no dental insurance purchased by yourself or by a family member or through a group plan from an insurance or benefits company.

3. have an adjusted family net income of less than $90,000

4. be a Canadian resident for tax purposes

5. have filed your tax return in the previous year

The program will cover cleaning, examination, x-rays, and restorative services, including oral surgery and extraction. Eligible individuals will receive a letter from the Canadian government inviting them to apply. Eligible individuals will receive a letter from the Canadian government inviting them to apply.

6. First Home Saving Account (FHSA)

The government introduced the first home saving account in 2023 to help first-time home buyers to save for their own home. Qualified Canadians have a lifetime contribution limit of $40,000 with an annual contribution limit of $8,000. FHSA allows Canadians to earn income in the account on a tax-free basis – similar to that of a TFSA account. Contributions made to FHSA are also tax deductible, similar to that of an RRSP account. The only difference is that you can only deduct the contribution you make in the calendar year against the income.

You can also carry forward one year of contribution limit. If you are qualified for the first home saving account, you can contribute $8,000 in 2023. You can also contribute an additional $8,000 in 2024. If you have not contributed in 2023, you can carry forward one year of contribution limit to 2024. In other words, you can contribute up to $16,000 in 2024 if you don’t have the money yet to make your contribution in 2023.

7. Revised Underused Housing Tax

If you are a real estate investor, you would have been very familiar with the Underused Housing Tax Act that came into effect in 2023 and was aimed to target foreign investors leaving their Canadian investment properties vacant. However, when the legislation was released, it affected the compliance burden on many Canadian owners, even though they would have no tax to pay. This completely contradicted the original intention of the Underused Housing Tax Act.

As a result, the government is making some changes to it. For one, they’ve extended the filing deadline for 2022 twice. Now, the filing deadline has been extended to April 30, 2024.

In addition to it, Canadian corporations, Canadian partnerships and Canadian trustees that own the affected residential properties, are no longer required to file for UHT from 2023 and onwards. If you are owning the entire apartment building that is condominiumized, you are also no longer required to file UHT from 2023 and onwards.

8. Trust Reporting Rules

CRA is imposing this new trust reporting rule starting January 1, 2023 for all trust relationships that exist during the year.

This affects Canadian real estate investors who own properties in trust for someone else, it also affects investors who own properties with a joint venture partner that is not on title. This also affects Canadians in general who are on title for a property for someone else to help them qualify for financing. Or, if you are like many Canadians, your names are added to your elderly parents’ home to help them deal with all the hassles, but you aren’t truly the owner of the property, this rule also applies to you. This goes beyond real estate – if you are added to your parents’ bank accounts and the amount is over $50K, you have a filing obligation.

The deadline to file is March 30, 2024. For more details about this new rule, you can refer back to this article we published earlier.

9. Short-term Rental Deductions

Starting from January 1st, 2024, if you operate a short-term rental in an area where such rentals are prohibited by the municipal government, like in cities such as Toronto or Vancouver, you won’t be eligible to claim any deductions against the income you earn from short-term rentals. This new rule affects those who use short-term rentals as a way to avoid issues with the Landlord and Tenant Board and to make their property portfolios cash flow positively. It’s important to prepare for this change if you own a short-term rental property in these affected areas. This is a significant shift in regulations, effective from January 1st, 2024.

10. GST/HST on purpose-built residential rebate

In September, an announcement by the Canadian Prime Minister put a spotlight on the GST rebate for new builds. If you’re constructing properties with four units or more, you can now claim back 100% of the GST paid. This change is set to reduce costs substantially for builders.

Fast forward to November 1, 2023, and the Doug Ford government in Ontario announced a game-changing policy: the removal of the full 8% provincial portion of the HST on qualifying new purpose-built rental housing. This initiative is designed to encourage the construction of more rental homes across the province.

Criteria for Eligibility:

To qualify for this enhanced rebate, a project must meet specific criteria:

- Construction must start after September 14, 2023.

- At least 90% of the property’s units should be designated for long-term rental.

- Only properties with four or more units qualify.

- Commercial-to-residential conversions are included, but subdividing a house into units does not.

- Single units, duplexes, triplexes, and housing co-ops are excluded.

- The rebate doesn’t apply to substantial renovations of existing rentals or new single-family homes, duplexes, or triplexes.

You can read more about GST/HST on purpose-built residential rebate here.

Until next time,

Cherry Chan, CPA, CA

Your Real Estate Tax Accountant