(Our last group workout at Radix Performance in Oakville. Source.)

A few of my friends become first time moms recently.

Being a new mom is not easy. Your body has to heal. You have to learn to breastfeed and you now have another life completely dependent on you.

It was definitely a big shock to me, both mentally and physically.

I rarely share this with anyone, but I still remember the days that I cried constantly in the first couple months after I gave birth to Robin.

Partly because of hormones, partly because I felt so bad that I didn’t know what the hell I was doing.

It was tough. I didn’t know how to feed Robin. I didn’t understand why she kept crying everytime I tried to feed her.

We sought professional help. We did every trick that would help us to get use to each other.

It didn’t get easier until a couple months later.

But it was so much easier the second time around with Bruce.

I knew exactly what to expect. I healed faster, I fed him well.

One of my friends visited me during that time and saw that I was fairly at ease and I recovered pretty well.

So after she gave birth to her first child, she was wondering why she didn’t feel as comfortable as I was back then.

She didn’t know me when I first became mom. She didn’t know that I was crying every night for the first month after I gave birth to Robin.

It was after the first child “trauma” that I felt I somewhat got a handle of taking care of a new born baby and what it means to be a mom.

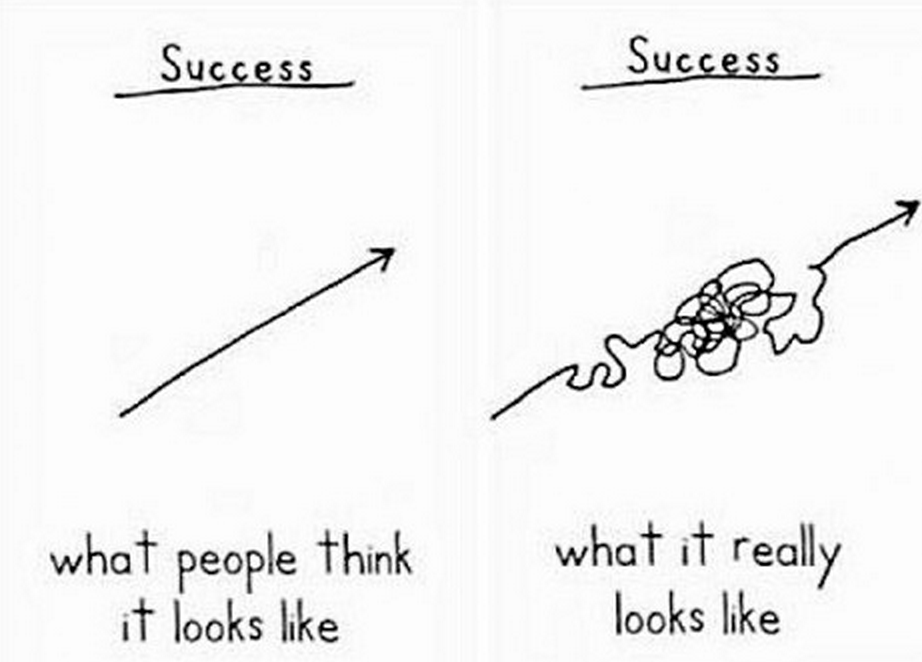

It’s really no different from the way people look at success.

Success is a mess. It doesn’t come in easy.

Entrepreneurship is definitely not for everyone. The road to have your own business is so lonely and while there are some people who might look at it head on and aim to get a commercial property for their business, it’s still a long way to get there, and it can still feel a little isolating.

Clients and outsider may see you as a success.

But the truth is, there’s staffing issues. There’s internet issues. There’s phone issues. There’s office rental issues. Then there’s software issues and IT problems, etc. etc.

Of course, some of these problems are easily resolvable. When setting up a business, it’s important to get yourself started with some Business Internet – EATEL Business offers multiple packages that may suit your company, regardless of how big or small the business is. With some internet packages, you can also get a phone line included. With a deal like that, you can save money.

You may not have enough clients today. Then you have too many clients and you need to hire the right person. It’s a mess!

You’re constantly jumping from one problem to another.

And few people can understand. The road can be so lonely.

If you’re like most entrepreneurs or real estate investors, you often start by working from home late at night grinding your business for 18 hours a day.

Similar to achieving success, the criteria to deduct home office expense can be quite confusing.

Let’s look at the criteria for deductions.

Criteria for deductions

You are eligible to deduct home office expense as long as you meet one of the criteria below:

- Your home office is the principal place of business; or

- You use the space only to earn business income and you use it on a regular and ongoing basis to meet your clients, customers, or patients

Principal place of business

If you have more than one place to operate your business, your home office must be the main location.

This means that as a realtor, you may have a room in your home where you make all your sales calls, prepare all your paperwork and perform bookkeeping functions, but you are indeed conducting the deals at different houses.

This means that if you are a real estate investor, you may have a room in your home where you do all the bookkeeping, scout investment properties, prepare N4 notice to evict your tenants and advertise your properties for rent.

You are allowed to use this same room for personal use, like playing online video games, but this room is the principal place of business.

Or: Only to earn business income on a regular and ongoing basis

If you qualify under the second criteria, the home office space must be used exclusively to earn business income. This means that personal use is not allowed in this place.

On top of the exclusive use of the home office space, you also need to use it to meet clients on a regular and continuous basis.

If you are a realtor that only meets your clients in your home office once or twice a month, unfortunately it does not count as “regular and ongoing basis”.

If you are a real estate investor that does not meet your tenants/clients in your home office at all (most landlords I know do not like their tenants to know where they live), chances are you probably cannot qualify to claim home office expense under this criteria.

What can you deduct?

Now, let’s assume that you qualify with one of the criteria above, what can you deduct?

You can deduct the following expenses:

- Maintenance costs such as heat, home insurance, electricity, and cleaning materials.

- Property taxes

- Mortgage Interest

- Home internet

- Repairs

- Capital cost allowance

If you rent, you can deduct rent.

You can deduct part of the expenses that are related to running your business. This can be calculated based on the size of your home office in relation to the size of your home.

More often than not, a taxpayer would come to me and say that I would like to deduct 20% of my home office expense. He may have a number in mind that he would like to reduce his taxes by and hence come up with the 20%. But the reality is, you need to prove that the 20% you claim is reasonable.

If you have a house that 2,000 square feet, 20% is 400 sf. Ask yourself if your home office size is 20% of your home.

Deductions must be based on a reasonable basis. If your office size is not 400 sf, you can’t simply claim 20% because you like the number 20%.

Deducting capital cost allowance against your principal residence also may not be a good idea if you are planning to claim principal residence exemption. Consult a professional accountant before claiming CCA.

What do you have to keep?

Similar to all the deductions, documentation matters.

You will need to keep all the invoices for all your utilities cost, property taxes, insurance, mortgage statement, internet expense and repairs.

If you rent, you will need to keep a copy of your lease agreement and proof of rent payment/receipts from landlord.

You will also need to keep the floor plan for your residence so you can provide proof that the 20% of home office expense you deduct is reasonable.

Limitation on deductions

Few people actually know that there’s a limitation on home office expense deduction.

You can only claim home office expense to the extent of the business income you earn.

Say you earn $100,000 gross revenue and incur $20,000 expense, your net income is $80K. You can claim up to $80K of home office expense.

Say you only earn $10,000 gross revenue and incur $11,000 of expense, you have a net loss of $1,000. You cannot claim any home office expense you’ve incurred during the year.

However, you are allowed to carry forward any undeducted home office expense to future years for deductions.

Caution

For the real estate investors who would like to deduct home office expense, Canada Revenue Agency auditors do not always see real estate investments as a business (despite how much effort we have to put in to run the portfolio).

Sometimes they may decide not to allow us to claim home office expense against rental income.

More often than not, the deduction is small that the cost of paying the tax back is much cheaper than the cost of fighting with them.

Be sure to consult someone that understands real estate investing before taking the deductions.

What if you’re an employee and you work from home

Deductions for employees are subject to different set of criteria.

You will need a form called T2200. Your deductions are allowed subject to what your employer says.

Talk to a professional accountant when you take the deduction.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

How to Deduct Home Office Expenses for Real Estate Investors [REVISITED with CRA latest UPDATE] - Cherry Chan, Chartered Accountant, Your Real Estate Accountant

[…] while ago I wrote a blog post about the eligibility to deduct home office expense for small business owners, real estate […]

Eric Bolduc

Hi Cherry,

I deduct home office expenses as an employee working from home (I get a t2200 and work from my kitchen).

For my real estate business (I owned 2 rental properties), I work from an office in the basement.

Can I deduct home office expenses for my real estate business AND employee working from home since I use distinct area of my house?

Cherry Chan

The answer is generally yes – but it really goes back to your particular situation. There’re times we advise our clients not to claim home office expense because it might affect their primary residence exemption claim. You should consult with an accountant to make sure you are covered from all end.