Real Estate Investors often ask me, how do I prevent myself from a CRA audit? Non-compliance can be a concern for any real estate investor if you become a victim of targeted audits.

CRA released a report in 2011. In that year, they perform both random audits and targeted audits. CRA was only about to detect 12.2% non-compliance in random audits while targeted audits, selected based on risk assessments, resulted in 46.7% of cases non-compliance.

Based on this study, CRA switched gears in 2012-2013 focusing all their efforts in performing audits on all high risks clients.

This shift had helped CRA exceed two of their key performance indicators: 1) they adjusted 79% of tax returns that they audited (target was 75%) and 2) they generated a higher fiscal impact per auditor ($423K per auditor vs. their target of $350K per auditor).

Who poses the highest risk of non-compliance in CRA’s eyes?

You guessed it right! Real estate investors propose to be at a higher risk of being audited.

If your reported income does not support your lifestyle…

If you have unreported capital gains on the sale of a property…

If you have unreported GST/HST on sale of a new or substantially renovated property…

If you have unreported GST/HST on sale of a new or substantially renovated property…

If you have received any rebates… or

If you are a property flipper…

Then you could be at the risk of a CRA audit.

Make sure you view my latest video sharing these tips!

CRA Audit Activities

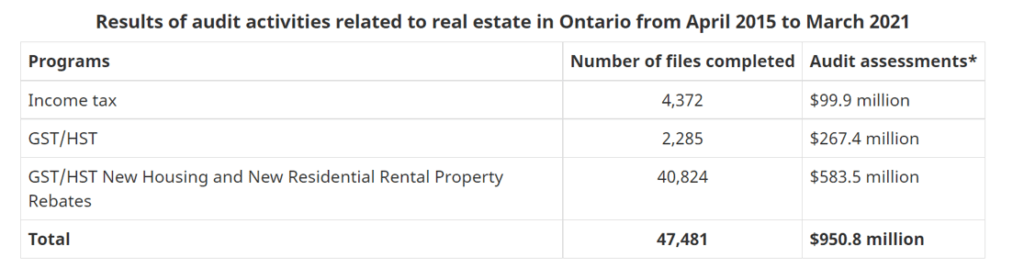

CRA regularly monitors tax compliance in real estate transactions. So much that CRA has dedicated a whole section explaining compliance to real estate investors, since 2015. You may even see the number of cases that have been audited in the past six years itself.

As seen in the image above, when it comes to real estate tax compliance, CRA audits three activities largely.

- GST/HST on New Housing Rebate and New Residential Rental Property Rebate

Many investors have asked me about the New Housing Rebate and I have talked about this before here.

Simply, New Housing Rebate is a rebate you get when you purchase a brand new home and you’re moving into it. The builder is assigned to claim the rebate on behalf of you and you are only eligible to receive it, if you are moving into the property.

The New Residential Rental Property rebate is available for you to claim, if you are not moving into the property and you are leasing it as a long-term rental property.

At closing, as a buyer you pay the full GST/HST to the builder including the rebate and after closing you can claim the rebate with documents showing you are leasing the property as a long-term rental.

Now, some of you, like my real estate investor clients may ask… “What if I claimed the New Housing Rebate, although I rented it as a long-term rental?”

The good news is that, CRA looks at intention! If you, unknowingly, claimed the New Housing Rebate and are worried about a CRA audit, there still may be time for you.

If you have a long-term lease signed by your tenant and the tenant is using this property as their primary residence… submit the signed lease, with the appropriate rebate form, along with a letter to CRA, explaining the situation. Request them to assign the mistakenly claimed rebate (new housing rebate) as a new residential rental property rebate instead.

Hopefully, you may still be able to fix the situation, if you are still within the two years of closing on the property.

- Income Tax & CRA Audits

When it comes to income tax audits, the CRA openly shares that it concentrates on property flippers. This is because after analyzing data, CRA came to the conclusion that some flips have not been reported or have been reported incorrectly.

CRA considers you a property flipper, if you buy and resell homes within a short period for a profit. You may be a professional contractor or renovator, a speculator or middle investors (wholesalers, pre-construction assignment dealers), or even an individual renovator.

Which brings us to one of the biggest misconceptions about property sale and taxes….

Are ALL property sales Capital Gain and taxable Income?

It can be difficult to decide if the profit that you made from the sale of a property is considered income or capital gain, and whether you’ll be subject to income tax or capital gains tax.

I have talked about this topic before here as well.

As many of you may already know, there’s a difference between the two – Capital Gain Tax vs. Income Tax. When there is capital gain from a property sale, it is only 50% taxable, whereas, income is 100% taxable.

CRA generally looks at a bunch of criterias to determine if the proceeds from the sale of a property fall under income or capital gains:

a) Taxpayer’s intention

b) Feasibility of taxpayer’s intention

c) Geographical location & zoned use of real estate acquired

d) Extent to which intention carried out by the taxpayer

e) Evidence that the taxpayer’s intention changed after purchase of real estate

f) Nature of the business, professional, calling or trade of the taxpayer and associates

g) Extent to which borrowed money was used to finance the real estate acquisition & the terms of the financing, if any, arranged

h) The length of time of ownership

i) Existence of other partners who share interests in the real estate

j) Nature of the occupation of the other persons referred to in (i) above as well as their stated intentions and courses of conducts;

k) Factors which motivated the sale of the real estate

l) Evidence that the taxpayer and/or associates had dealt with extensively in real estate

Some common examples of what may be considered as Income in a CRA Audit:

- Assignments, flips, land developments

- Wholesaling service, rent to own

Now again, if you own your properties inside a corporation, it is generally taxed at 12.2%. Whereas, if you own in your personal name, the income is subject to a marginal tax rate as high as 53.5% in Ontario.

I’d like to remind you again that every individual’s situation is different and therefore, it’s best to speak to a qualified professional. You can book an appointment here.

- HST on the sale of a property

When it comes to HST on the sale of a property, if you are a builder, specular or middle investor, CRA is looking for you.

HST implication on wholesale or pre-construction assignments

Simply saying, if you are a wholesaler or pre-construction assignment dealer, CRA is targeting you in their audits.

As a wholesaler, as you are securing a deal with the seller of the property off the market, you turn it around and sell it to the owner/investors that are interested in these properties and not selling the property yourself.

The profit that you’re making is typically considered as wholesale fees. Wholesale fees are considered commercial activities in CRA’s eyes and … you are liable to HST and the money you earn is taxable. Wholesaling is subject to HST. Only residential property sales are HST exempt!

As a pre-construction assignment dealer, you may enter into multiple agreements of purchase and sale to purchase pre-construction homes. You don’t intend to close on any of these contracts. You’re planning to assign the commitment to someone else before closing, making a profit on the appreciation.

As it turns out, the profit that you make is taxable. And the profit that you make, together with the deposit reimbursement you receive from the buyer, are subject to HST.

You may wonder – How would the CRA know?

CRA has the history of obtaining court orders which force the builders to provide a list of properties that have different names between the initial agreement of purchase and sale AND the person who actually closed the properties. If the purchaser listed on an agreement of sale is different from the name of the person closing on the property… CRA does the maths.

As I always say, the taxman sees everything!

Some real estate investors have been lucky enough to get away in the past, but after the CRA obtained a court order, they have been successfully challenging those middle investors who have been selling wholesale properties on assignment.

When you sell on assignment, CRA has taken a very aggressive stand that the assignment fees that you collect is subject to HST. Therefore, as a real estate investor when you sell on assignment, consider charging the HST fees in your sale price.

Another consideration, CRA has also stated that the down payment pre-construction dealer initially put down on the property that they later sell and get reimbursed for by the new buyers, is also taxable.

To avoid all these taxes, a good strategy for pre-construction investors is to close the property themselves, rent it out for a year and then sell it.

HST implication on substantial renovation on flips and new homes for sale and for rental

The HST implication applies if the substantially renovated property was used as a flip, or if you’re building a new home for sale or rental purposes, or even if you are converting a commercial property to a residential property…

A property is considered substantially renovated if…

90% or more of the existing building is removed or replaced.

If you “gutted a house” from top to bottom, you may be required to charge HST on sale of a property.

In many cases that I have come across, the HST impact has covered almost the entire amount of the profit. It is therefore important to take in account the HST implication of substantial renovations.

Also bear in mind, if you are building a new residential rental, then you’re considered a builder.

You need to pay HST on the Fair Market Value of the rental when the property is ready to move in. You can offset the HST payable by claiming the HST you pay to build the new rental. Only the net HST amount is payable. You can also qualify for HST New Residential Rental Rebate

And if you’re building a new house to flip, you’re also considered a builder.

So, similar to “building a new residential rental”, you need to charge HST on Fair Market Value at sale of the property, and you can offset the HST payable by claiming the HST you pay to build the property. Only the net HST amount is payable.Moreover, you can also claim HST Residential Property rebate here too, just like a builder.

Hope this blog post has helped you understand your taxes and prepare better. Let’s not get ourselves in a CRA audit!

Until next time,

Happy Canadian Real Estate Investing

Cherry Chan, CPA, CA

Your Real Estate Accountant