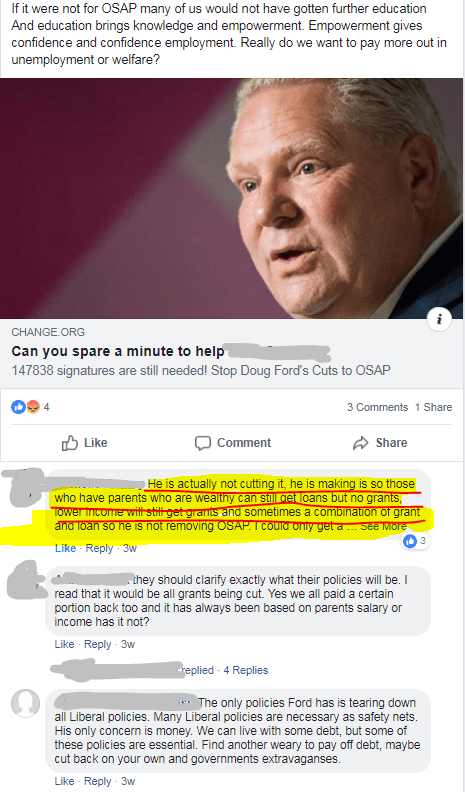

I saw this post a while ago on my FB feed. A friend of mine wanted to “stop” Doug Ford to cut OSAP.

Most of us only read the news from its title/headline. If you see the title of Doug Ford cutting OSAP, I personally would be offended.

Doug is not really cutting entire OSAP, he’s only cutting grants that are made to kids who come from the wealthy background. Hence, the title probably isn’t sexy enough, so cutting OSAP as the title works, and that’s what everyone saw.

For the record, I don’t agree with all his cuts, some are necessary as this one, some are controversial.

While our government is constantly under attack to make cuts and be more financially responsible, we, as real estate investors have to earn every single deduction that we take.

Here’s the first half of the two-part series on the best practice on how to set up your back office to audit shield against CRA.

1. Understanding the general deduction rule

In the Income Tax Act, it specifies that you can deduct expenses that you incur to earn business income or property income, subject to a bunch of exceptions.

This means that if you incur the expenses, such as mortgage interest, property taxes, utilities, etc. to earn property income, you are eligible to deduct the expenses.

Some expenses are not so obvious, such as buying your real estate agent lunch, connecting with other real estate investors via coffee, etc.

I always tell my clients to keep all your receipts and discuss with us at the end of the year when we file your taxes.

In CRA’s eyes, you need documentation to support your deductions. No receipts, no deduction for sure. That’s low hanging fruit from them.

The minimum standard for deduction is that you need to keep the receipts, credit card statements and bank transactions don’t count.

Now that you have your receipts, have the conversation at year-end with your accountant to see if you can deduct the expenses or not. ?

2. Paper system vs. electronic system

Let’s face it. Some receipts are printed on thin glossy paper. They fade over time. When I say they “fade over time”, it’s an understatement.

They fade pretty much immediately after they’re printed from the cash register.

CRA does allow storing receipts electronically, but the storage of your electronic receipts must be in Canada.

If you save it in your back-up drive in your Miami vacation home, that probably won’t work.

A cloud-based system such as Dropbox may work, provided that the server must be in Canada.

If you’re not sure, a backup drive in your Canadian home would count.

The use of bulk thumb drives to store all the documents safely could work, as they are independent storage devices where you can still access the files, regardless of location.

If you opted for the paper system, no worries.

3. Folder system

Whether you are using paper or electronic system, I would suggest that you set up a folder for each property each year.

Keep all the receipts/invoices occurred during the year, such as insurance, property tax bills, mortgage statements, repairs & maintenance receipts, etc. in the folder.

This will help you to keep track of all the work that has previously been undertaken on your property, which could be very beneficial going forward.

4. One bank account for one property, if feasible

I prefer one bank account for one property.

This bank account already does part of the bookkeeping for me.

- All rent related to this property goes in this account

- All expenses related to this property comes out from the same account

At the end of each quarter, all I need to do is to go through all the transactions in the bank account to see if I am making money or not.

Half of the bookkeeping is already done for me.

I can easily see how much money I am making or lack thereof.

I can make sure I take every single deduction that went through my bank account.

It’s getting long. Let’s break it down to two posts and we will share with you the remaining in the next post.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Johnny

Hi Cherry, great blog.

I have a question about a specific arrangement. My wife and I own a house together, and it was our principal residence for the past 5 years. We have now moved into a condo that we originally purchased as an investment property. However, we will elect to keep our house as our designated principal residence for 4 years, i.e. subsection 45(2). In the meantime, we are renting the house out to earn rental income. Can we deduct the mortgage interest for the house, even if it is designated as principal residence in this case? Also, if we refinance the house and use the proceeds to pay off the condo’s mortgage, can we also deduct the additional interest associated with that? Thanks.

Cherry Chan

Hi Johnny, we can’t offer specific advice over the internet. But you are welcome to check out one of our videos https://youtu.be/VxyOmiAxA4k and it may give you an idea of what the tax impact is from refinancing.

Have a great day.