What does the BOC’s interest rate hike mean?

In the past two years, the Canadian government had done two things to help fellow Canadians to pass this tough pandemic time.

- Lots of subsidies, grants, and benefits were offered to local businesses and fellow Canadians.

- Canadian interest rates had been lowered to the historic level at 0.25% to stimulate borrowing and investing.

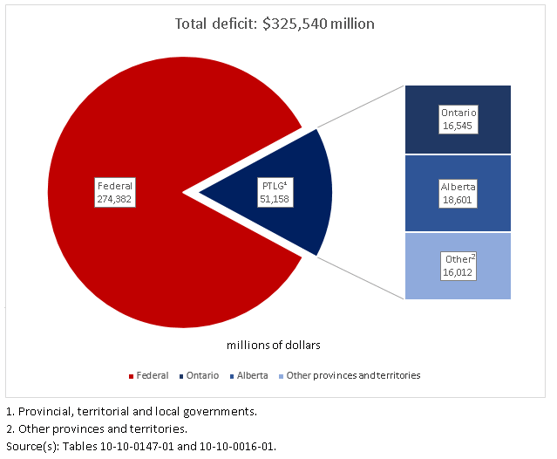

Our government has been incurring a substantial amount of deficit year in and year out before the pandemic emergency relief measures. With the unprecedented amount of benefits and subsidies offered during the pandemic, the Federal government had increased their deficit by twelvefold, by $274.4billion in 2020.

If you combined the Federal government deficit with the provincial, territorial and local governments, the consolidated deficit was $325.5 billion for 2020.

Have you wondered how the Canadian government can afford to have this much deficit in one year?

The simple answer is that – they borrowed. They borrowed from the Bank of Canada. They borrowed A LOT from the Bank of Canada.

The BOC purchased bonds, treasury bills, etc. from the Government of Canada. It then turned around and offered a portion of them to the private market including banks and security traders. The BOC kept the remaining portion without offering it to the public.

Because Bank of Canada is wholly owned by the Government of Canada, for those of you who know accounting, the portion that’s kept by BOC is essentially a digital entry that’s created to increase cash and increase liability.

This is how they increase money supply in the system – yep, by debiting cash, crediting liability.

Because of the amount of subsidies and grants offered by the government during the pandemic, we created an unprecedented amount of debt in 2020.

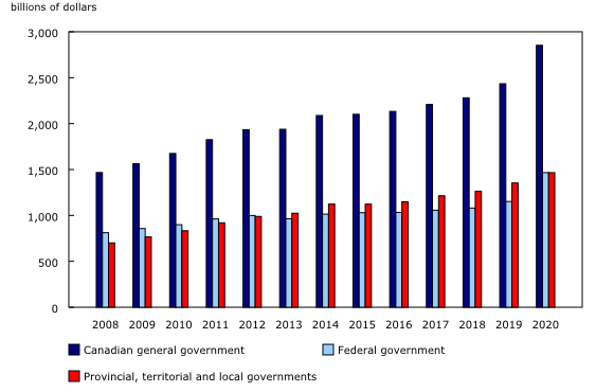

Cumulatively, our total government debt had grown to $2,852 billion as of 2020. See below chart from Statistics Canada.

With an increase in money supply over the last two years, as well as low interest rates offered by the Bank of Canada, it isn’t surprising to see that inflation surpassed 5% in January 2022.

As real estate investors and homeowners, we have all seen and heard about the recent unhinged real estate market, partly stimulated by cheap money being offered by banks.

One of the ways that the BOC can limit inflation AND control the overheated housing market is to increase the prime rate.

So they did. They announced a rate hike of 0.25% last week.

And we’re expecting to see more…

Increasing the prime rate means that the cost of borrowing is higher for everyone. We’re less likely to borrow to invest, to purchase our next home or our next investment property. Interest is higher and therefore we can afford less in terms of housing cost.

Increasing the prime rate also means that the cost of borrowing is higher for the Government of Canada.

With that being said…

How do you prepare for the BOC’s interest rate hike?

Now, as a real estate investor you may be wondering, what can you do to prepare yourself for these inevitable rate hikes?

We all knew that this was coming. We just didn’t know how much increase we would see over the next year or so.

Good news is that the gradual increase in interest rates over the year to help slow inflation, does not mean the property prices of your investment properties will stop rising – the prices of the market may take some time before they stabilize. Inflation will most likely increase even further (in the near future) before things start to lower again.

- Lock in with Fixed interest rate mortgage

If you are a real estate investor you already know the difference between the two. But, if you are just starting out as an investor you should know…

With a fixed-rate mortgage, your interest rate and payment stay the same over the mortgage term. Fixed-rate mortgage is tied to bond rate, not Bank of Canada prime rate.

With a variable-rate mortgage, the interest rate can move up or down according to the lender’s prime interest rate, which is also tied to the Bank of Canada prime rate.

What this means with a fixed rate mortgage:

- You’ll know when you’ll be able to pay-off your mortgage, as the interest stays the same

- You’ll be able to confidently budget for mortgage payments, knowing exactly you have to pay each month

- You can expect the initial interest rate to be higher than a variable-rate mortgage.

- You can expect to be locked into your interest rate for your entire mortgage term (or pay penalties for breaking it)

The biggest downside of locking in a fixed rate mortgage is the cost of penalty. Penalty is often calculated as greater of

- 3 months of interest or

- Interest rate differential between your existing mortgage or their advertised rate or posted rate

From my personal investing experience, this could amount to tens of thousands of dollars in terms of penalty.

When you commit to a fixed rate mortgage, make sure you are not planning to 1) sell or 2) refinance within the term of your mortgage.

With a variable rate mortgage:

- Your initial interest rate will most likely be lower than a fixed-rate mortgage

- If the prime rate falls and your interest rate falls accordingly, your monthly mortgage payments decrease (vice versa, as the prime interest rate has increased and is expected to continue to increase). If the prime rate rises and your interest rate goes up accordingly, your monthly mortgage payments increase accordingly as well..

- You can convert to a fixed-rate mortgage at any time (especially when you know there’s going to be an expected hike in interest rates)

Here’s the little hack that I normally do – commit to variable, but pay fixed-rate mortgage amount

If I were to borrow $800K from the bank to purchase a rental property, I would opt for a variable rate.

Variable-rate at 1.60% means that my monthly payment amount = $2,797.46

Fixed-rate at 2.69% means that my monthly payment = $3,234.26

For those investors who want peace of mind that their monthly payment won’t go up in the next few years, here’s what I would do…

Sign up for a variable rate, but increase your monthly mortgage payment amount to the fixed amount.

With an $800K mortgage, the bank requires me to pay $2,797.46 if I go variable.

I would instruct the bank to make a payment of $3,234.26 instead – so I am already used to paying a higher amount.

The extra $437 payment that I make goes straight to pay down my outstanding mortgage on a monthly basis.

At the end of one year, my mortgage outstanding amount is lowered by $5,306 as compared to opting in for the fixed mortgage.

My cash outflow is exactly the same, but the extra goes straight to my mortgage principal paydown, which also carries a compound effect on my monthly mortgage payment.

By the end of the second year assuming there is no rate increase, my mortgage outstanding is lowered by $10,757 cumulatively.

If you are concerned, go for a variable, but pay as if you’re committed to a fixed rate mortgage, assuming you have an option.

- Invest in cash flow positive properties

We always invest in cash flow positive properties.

If the rental income isn’t enough to cover all expenses on its own, we would not consider buying the investment property. As a minimum, we need to generate enough cash flow from our overall portfolio to support this cash flow negative investment.

With this principle, even if there’s a rate hike, your overall portfolio can still sustain itself, without further cash flow injection from you.

Yes, you can still find cash flow positive properties. You just have to look harder and be more creative.

We bought a couple of properties in the 2017/2018 just before the “market downturn”. We bought at the peak that year. I remember questioning myself why we committed to purchase these properties when they were priced at the top.

Thankfully, they have been cash flowing positive from day 1, even though we bought them at the “peak”.

Fast forward to 2022, these properties continue to provide strong cash flow and they have the least loan to value ratio among our portfolio.

- Restructuring debt to seek out lower cost of financing

Never stop finding lower cost of borrowing. Mortgage and debt carrying costs are generally the biggest expense as real estate rental.

As we speak, we’re in the middle of refinancing 3 of our investment properties. We’re trying to convert these mortgages to line of credit instead.

Instead of paying a blended mortgage payment, line of credit allows us to pay interest only, lowering the monthly debt carrying cost.

If the plan goes well, we’re hoping to switch the B-lender financed properties to line of credit as well. Imagine, switching from a B-lender mortgage to a line of credit with interest only payment. We can easily increase our cash flow by $1,000 or more.

We’ll still use the excess cash flow to pay down our debt, but we get to choose the amount we pay.

Even if interest rates go up, we get the flexibility to pay less into our principal payment, maintaining the same level of cash outflow monthly.

Make sure you constantly look out for lower cost of borrowing to minimize the biggest item in your rental operation.

- Take advantage of the dip

You have probably heard about the quote by Warren Buffet, “be fearful when others are greedy and be greedy when others are fearful.”

When there are multiple hike increases, we expect to see an adjustment in the real estate market.

It may not be a dip at all. It may just be the market slowing down.

This can be the perfect opportunity for capable investors to enter the market, take advantage of the slow down.

Remember the market downturn in March 2020 when nobody was buying properties?

- Relax, rates will remain low… for a very long time

From the narrative on Statistics Canada’s website regarding 2020’s government debt level, “Our debt charges (the Government of Canada interest expense) remain low despite record debt levels. This is a result of increasing money supply, encouraging lending and investment and keeping short-term interest rates close to zero. This allows our government to finance the unprecedented deficits generated during the pandemic at low cost and to refinance maturing debt at lower rates.”

The flip side of this narrative is that when the Bank of Canada increases its prime rate, coupled with the stop of quantitative easing, means that the government will have to finance their future deficit and refinance their current debt at higher rates.

Remember, when the BOC increases its prime rate, it’s also increasing the interest expense that the Government of Canada is paying.

The Government of Canada has about $2,852 billion of total liabilities as of 2020. A rate change is going to increase the cost of financing, not just for us, but for our government as well.

Yes, the rate is likely going to increase again.

No, it won’t have a substantial increase like back to 23% in the 1980s, or even back to 8% in the 1990s…or else our government can go broke.

As the interest rate continues to hike, it is predicted that people will be able to borrow less. This is, when you as a real estate investor, should be considering growing your real estate portfolio.

A proper corporation structure can help to minimize the amount of taxes. To speak with a knowledgeable qualified real estate accountant, book a consultation here.

If you are looking to buy this year, don’t get your hopes up for significantly decreased home prices either. As I mentioned before, the gradual rate increases will take a while to affect the housing market and there are other factors driving the real estate market beyond just low-interest rates, including low inventory.

Hope this article helped you understand how the Bank Of Canada’s interest hike may affect you!

Until next time,

Happy Canadian Real Estate Investing

Cherry Chan, CPA, CA

Your Real Estate Accountant