Not budget related, just need to share it with everyone…

1. CRA made an announcement March 27 that they will impose NO penalty and interest on UHT late filing until October 31, but UHT filing deadline is still May 1.

At this point, we are unsure as to how this could affect future late filing. Under the Income Tax Act, if you late file for two years in a roll, a higher amount of penalty would be imposed on the second year’s tax filing.

We would still encourage our clients to file by May 1 deadline this year.

2. Change to the foreign buyer plan – now they are allowed to buy, but may still be exposed to the Ontario 25% foreign buyer tax rule

Now back to the budget

- No increase in personal tax rates – thank goodness

- No increase in inclusion rate of capital gain – remains at 50%

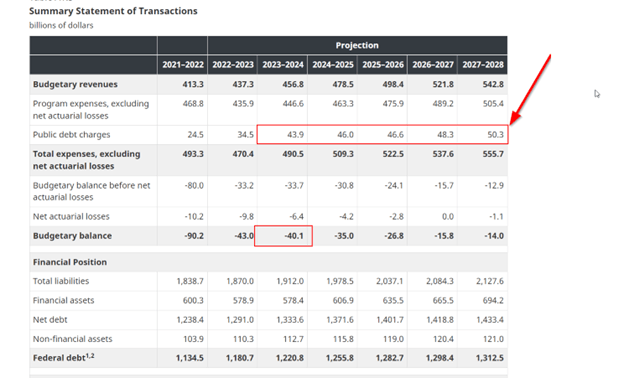

- Budget deficit and budget spend and cost of debt $40 billion spent – no coming back to balance the book – it’s like the government has given up.

Based on the new budget, the government is going to have a deficit by more than $40Billion dollar.

It’s always interesting to see how the government spends, and compare their spending habit with hardworking Canadians like you and I.

In last year’s budget, the revenue was about $437.3 Billion and we spent $43Billion more than what we received.

In current year’s budget, we are projected to spend $40 billion more than what we earned.

Imagine, as an individual, if you spend $40K more than what we earn, we really need to dig into our assets, for someone who’s financially responsible and have assets saved aside.

And we can either try to be responsible by increasing our revenue and also decreasing our expenses at the same time to “balance” our own personal budget.

It’s sad that the Government of Canada isn’t really financially responsible.

It’s better to borrow, fund deficit using debt, and refinance our debt and pay the increase interest expenses. The solution to our financial problem seems to be …let’s pay for our deficit with infinite amount of debt.

This public debt is created by borrowing more money (from printing), which in terms fuel inflation.

Our cycle of quantitative easing from printing money and quantitative tightening can be more frequent in the future.

Now, let’s dig a bit deeper into how this budget actually affects everyday Canadians…

Let’s start off with what would affect the Canadian Real Estate Market

Lowering criminal interest rates to 35% from 49%

It sounds like the federal government will be publishing a guideline to allow Canadians with mortgages who are facing exceptional circumstances to lower their monthly payments by extending amortizations, adjusting payment schedules, or authorizing lump-sum payments. Existing mortgage regulations may also allow lenders to provide a temporary mortgage amortization extension even past 25 years.

An additional $4 billion will be used to implement a co-developed housing strategy. And the government promises to consult on changes required to remove regulatory barriers for homebuyers seeking access to alternative financing products.

Registered Education Saving Plans (RESP)

Maximum withdrawal amount for beneficiaries is currently capped at $5,000 in a 12 month period for beneficiaries who are enrolled in a qualifying program full-time. The amount would be $2,500 if the beneficiaries enrolled part-time.

Budget 2023 proposes to allow the maximum withdrawal to increase to $8,000 for full-time programs and $4,000 to part-time programs.

Budget 2023 also allows divorced or separated parents to open a joint RESPs account together.

Registered Disability Saving Plans (RDSP)

If you have a family member that qualifies for the disability tax credit, a RDSP can be setup and up to $200K can be contributed to the plan to earn income, on a tax deferred basis, for the beneficiary who is qualifies.

To set up such a plan, you must have a legal representative of the beneficiary. Legal representative of a minor is relatively easy, but being a legal rep of an adult can be expensive and lengthy.

The government is proposing to allow the qualifying family member to open an RDSP without officially being legal guardian and this will be extended to Dec 2026. Budget 2023 also expands the definition of the qualifying family member to include a brother or sister.

Canadian Dental Care Plan

In September 2022, the government set up this Canada Dental Benefit for eligible parents or guardians with direct, up-front, tax-free payments of up to $1,300 over two years, per child, to cover the cost of dental care for their children.

In Budget 2023, the federal government is expanding this Canada Dental Benefit to provide $13 billion over five years, starting 2023-24, and $4.4 billion ongoing to Health Canada to implement the Canadian Dental Care Plan. The plan will provide dental coverage for uninsured Canadians with annual family income of less than $90K with no co-pays for those with family incomes under $70,000.

Groceries rebate

The media seems to put a lot of focus on the groceries rebate. The groceries rebate will be distributed out as part of the GST tax credit and the tax credit would gradually phase out for family income above $39,826.

For those eligible, the maximum you could get is $153 per adult and $81 per child, and $81 for single supplement.

Tradesperson deduction

In the past, a tradesperson can claim a deduction of up to $500 of eligible new tools required for employment if the amount spent exceeds the Canad employment credit of $1,368 in 2023.

This amount is proposed to be increased to $1,000.

Alternate Minimum Tax (AMT)

If you don’t already know, when you file your personal income tax every year, you’re also evaluated under a different system called the Alternate Minimum Tax. Essentially, your income, tax deductions and tax credits are being plugged into a different formula to come up with a different tax payable balance. CRA compares that balance with the amount payable calculated under the regular system.

If the tax payable calculated under the Alternate Minimum Tax system is higher than what you normally pay under the regular progressive tax system, you’re required to pay the additional tax.

Traditionally, this tax would catch people who has sold shares of qualified small business and utilizes their lifetime capital gain tax exemption, or made a large amount of donations and have a huge amount of donation credit. Traditionally, it’s used to target people who have large income but very little tax payable.

Now, the government is proposing to change the formula to calculate increase Alternate Minimum Tax to these ultra wealthy individuals AND eliminate those people who are truly middle class by increase the exemption.

It wouldn’t be relevant for majority of Canadians, but for those who’re affected, you could pay as much as double of the tax payable under the new rule.

Student benefits

Who here has used the Canada Student Grants benefits? I did.

Budget 2023 proposes to increase Canada Student grants by 40%, raising the interest-free Canada student loan limit from $210 to $3—per study week, and waiving the credit check requirement for adult students.

Air Travellers Security Charge

For those of you who travelled by air, you would have experienced the excessive amount of wait time at security check in.

Budget 2023 is proposing to increase the Air Travellers Security Charge from $7.48 to $9.94 for a domestic flight. The transborder charge will increase from $12.71 to $16.89 and the charge for other international travel will increase from $25.91 to $34.42.

These new rates will kick in for any payments made on or after May 1, 2024.

Small Business Credit Card Fees

This is an interesting one. For those of you who don’t know, every time we use our credit card to pay, the businesses receiving the credit card payments are being charged by VISA or Mastercard as much as 3.6% processing fees.

I see it all the time in my business. The cost is so high that we have to pass on the charges to our clients.

Budget 2023 announced that the government had reached some sort of commitments with Mastercard and VISA to lower their processing fees. And small businesses will see a decline in their processing fees as much as 27%.

GAAR General Anti Avoidance Rule

If CRA can’t argue with you based on the Income Tax Act or Excise Tax Act, they would try to apply GAAR. They have further clarify in writing how GAAR really applies to all tax planning scheme and of course, trying to make their jobs a lot easier.

Seems like a lot, doesn’t it?

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant