This post is for small business owners who have been investing inside their corporation. If you are just starting out, or if your investment funds come from your personal accounts, this may not be for you.

For those of you using personal savings or funds from a principal residence home equity line of credit, stay tuned for future content on whether you should own your investment in a corporation or not.

Now, let’s dive into today’s topic: Should Small Business Owners Continue to Invest Through Their Corporations?

For small business owners in Ontario, you’re typically paying a 12% corporate tax if eligible for the small business deduction. For other businesses, the rate is about 26.5% for active business income.

It’s common for accountants to advise clients to keep as much money as possible within the corporation for investment purposes. If you look at the personal tax system, which is progressive, you may pay up to 54% in Ontario. By keeping more money in the corporation, taxed at 12%, instead of withdrawing it and paying personal tax rates, you have an extra 42% available to invest inside the corporation.

At some point, the money must be withdrawn, but retained earnings can be distributed strategically over time, such as in retirement, to lower overall family taxes. Many use their corporation as an investment vehicle, creating their own retirement savings plan.

This strategy was effective until the government announced a change to the capital gain inclusion rate.

Capital Gain Inclusion Rate Change

Earlier this year, the Federal government altered the capital gain inclusion rate system. Previously, if you made $100,000 in capital gains, either in your personal name or your corporation’s name, only 50% of the gain was taxable. This meant you paid tax on $50,000 (i.e., $100,000 x 50% inclusion rate).

Now, the government has implemented a tiered system. For capital gains earned in a personal name, the 50% inclusion rate still applies for the first $250,000. Any capital gain above that amount is taxed at a 67% inclusion rate.

However, for gains earned in a corporation, the new rule is stricter: the inclusion rate is 67% on all capital gains, without exception for the first $250,000.

In other words, if you make $100,000 in capital gains in your personal name, you still pay tax on only $50,000. But if the same gain is earned inside a corporation, you must pay tax on $66,667. This means your taxable income increases by $16,667 solely due to investing through a corporation.

The Key Question for Small Business Owners

Given this change, small business owners must consider whether to:

- Draw the money out of the corporation, pay higher personal income taxes, and invest in their personal name to benefit from the lower 50% inclusion rate for the first $250,000 in capital gains.

- Keep the money in the corporation, maximize the investment amount due to the lower 12.2% corporate tax rate, and potentially earn higher returns, albeit with the 67% inclusion rate on capital gains.

Report Insights

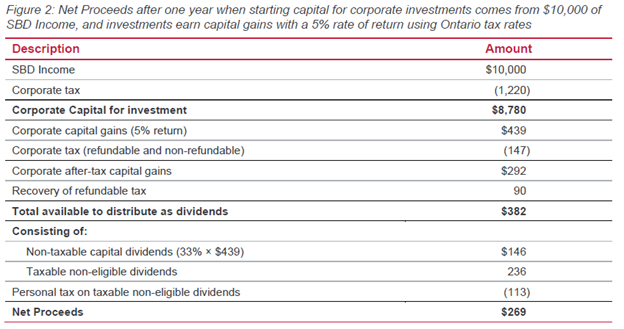

CIBC released a report in October 2024 on this topic, using two scenarios for comparison:

Scenario 1: Investing Within the Corporation

$269 is net of all of corporation tax and personal tax. $269 is the true after tax money that the small business owner gets to keep.

A company earns $10,000 in corporate income, pays 12.2% corporate tax, leaving $8,780 for investment.

A 5% capital gain on the $8,780 investment results in $439 after one year of investing.

Under the new inclusion rate, the corporation pays $147 in tax before receiving a refundable portion.

Assuming the small business owners declare the entire after tax return on investment as dividend to themselves individually, the taxable dividends trigger a refund of $90.

This means that the corporation has $292 available for distribution to the business owner.

As we all know, once we receive the dividends individually, we also need to report it on our personal tax returns and pay personal taxes on it.

At the highest marginal tax rates, this small business owner is required to pay $113 tax, leaving $269 net proceeds.

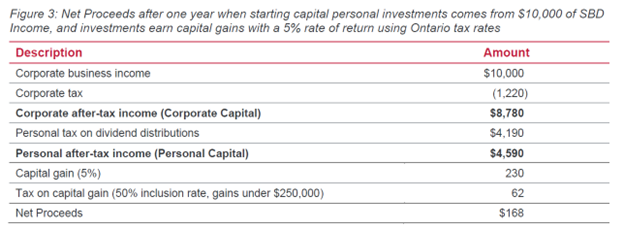

Scenario 2: Taking Dividends and Investing Personally

With lower capital gain inclusion rate in personal name, this small business owner will pay $62 of personal income tax, netting $168 net after tax proceeds.

This scenario is using the same facts – earning the same $10,000 corporate income. Instead of investing in the corporation, the money is taken out as a dividend and invested personally to benefit from the 50% inclusion rate on the first $250,000 in gains.

In the illustration below, the corporation earns $10,000 net income, pays corporate tax at 12.2% and declares all after corporate tax earning of $8,780 to the shareholders individually.

The small business owners receive the dividends, pay the highest marginal tax rates (if you have less personal income, you get taxed at a lower rate). In this case, he pays $4,190 to CRA as personal tax.

Now he’s left with $4,590 to invest.

Assuming that he’s getting the same 5% rate of capital gain return on this $4,590 investment, he will be getting $230 after one year of investment.

As you can see, the small business owners get $269 if they invest through the corporation.

If they choose to take the money out and invest personally, they only need $168.

It’s easy to make the decision – small business owners should continue to invest in a corporation structure.

Word of caution:

Note that the calculations use the highest marginal personal tax rate. If your personal tax rate is lower, or if you plan to withdraw the funds during retirement when rates may be lower, your situation will differ. As always, you should consult with your accountant that knows your situation the best for advice before continuing with your investing structure. If you don’t have a trusted advisor, feel free to reach out to our office.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant