It’s March 18. Our team is getting extremely busy during tax season.

With the lockdown rules changing by the minute, we were fortunate enough to visit a ski hill for a couple of runs this past weekend.

I learned skiing properly the very first time in the last ten years. I wouldn’t consider myself as a control freak, but I do prefer to have a bit more control than skiing… at least that was how I felt last year.

With a couple more falls and another proper lesson this year, I feel that I have a lot more control this year. 😊

It wasn’t easy for sure, but it was still enjoyable.

All I want is be the example that my kids can follow.

It’s okay to start something new.

It’s scary to start something new.

And it is going to hurt when we start something new.

It will get better with practice… and practice makes progress.

Hopefully, that few falls that I suffered were well worth it. 😉

In my accounting practice, I work with hundreds of real estate investors. Many real estate investors make good money and have built a great rental business using real estate.

Some landlords, however, are not as lucky as others. Some tenants are delinquent in rent and they refuse to pay.

Late last year, we came across a service offered by a Toronto-based company called Landlord Credit Bureau.

Essentially Landlord Credit Bureau partners up with Equifax Inc., a Canadian credit bureau that tracks a tenant’s rent payments.

Landlords report the rent payment history to Landlord Credit Bureau.

If tenants are on time, the rent payment history builds up the tenants’ credit score.

If tenants are late, the late payment history also hurts their credit score.

Tenants get rewarded for being good tenants. They also get penalized for being delinquent.

You can find out more about them in this Financial Post article.

Before this service, we, as landlords, have no way to report the amount of outstanding rent owed by tenants.

Many landlords, myself included, either “eat the loss” or go through the collection agency to recover some of the losses.

When I learned about the service offered by Landlord Credit Bureau, I thought it would be a great tool to level the playing field between landlords and tenants.

But being a busy mom, I didn’t really get a chance to look into it much further.

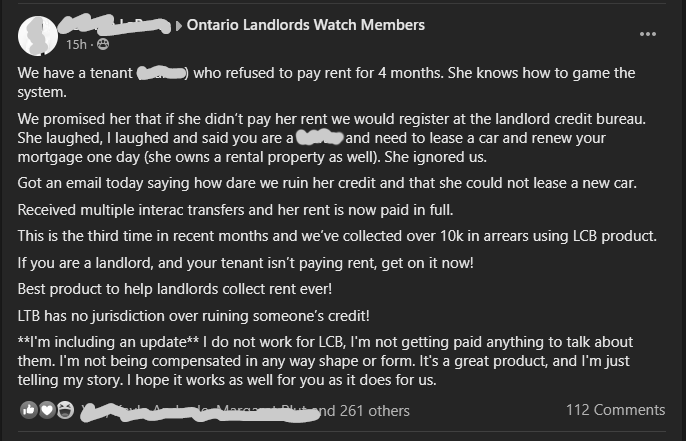

Then I saw this earlier this year on Facebook…

For the record, I am not affiliated with Landlord Credit Bureau in any shape or form.

I just want to spread the message, share with you the tools that some of the landlords are using to level the playing field.

Do your own research. See if this is something you want to add to your toolbox. 😊

Hopefully, we can help the well deserving tenants to build up the credit that they would need to buy their own homes one day.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Ian Wilkinson

This is an uncertain area of law in relation to credit defamation. If you report without an actual Order from the LTB a tenant can file a claim in Small Claims Court based on unproven defamation. This area is uncertain because some judges will accept this argument if no Order, some will not. Just saying there is uncertainty however an informed decision is better than otherwise. Sometimes this will work well … it is a very good idea but should be used with discretion depending on the tenant and the circumstances.