As we move into 2025, several key tax changes will impact Canadians. From income tax bracket adjustments to new rules for short-term rentals and trust reporting, here’s everything you need to know about the income tax update to plan ahead.

Part 1: Updates for Everyone

1. Federal and Provincial Tax Bracket Adjustments

Income tax brackets for 2025 have been adjusted to account for inflation. This means a greater portion of your income will be taxed at lower rates.

Combined Federal and Ontario Tax Example (for $100,000 Income):

In 2024, you pay $21,031 tax, netting $78,969 after tax income.

In 2025, you pay $20,646 tax, netting $79,354 after tax income.

Impact: If you earned $100,000, you’ll save about $385 in taxes for 2025 compared to 2024.

2. CPP Contributions: You’re Paying More in 2025

The Canada Pension Plan (CPP) enhancements continue, leading to higher contributions in 2025 but promising increased retirement benefits.

How CPP Is Traditionally Calculated

The Canada Pension Plan (CPP) contribution formula is straightforward. Contributions are based on your pensionable income (employment or self-employment earnings within certain limits) minus a basic annual exemption.

Traditional Formula:

(Pensionable Income − Basic Exemption) ×Contribution Rate

- Pensionable Income: The amount of income subject to CPP contributions, up to the Year’s Maximum Pensionable Earnings (YMPE).

- Basic Exemption: A fixed amount of $3,500 that’s subtracted from your pensionable income.

- Contribution Rate (2025): 5.95% for employees (11.90% for self-employed).

Example:

If you earned $50,000 in 2025:

- Pensionable Income = $50,000

- Basic Exemption = $3,500

- Contribution Rate = 5.95%

(50,000 – 3,500) × 5.95% = $2,762.75

Introduction of Tier 2 CPP Contributions (2024)

In 2024, the Canada Pension Plan (CPP) enhancement introduced Tier 2 contributions, adding an additional layer to the traditional calculation. This change was designed to expand CPP benefits for higher-income earners by increasing the range of earnings subject to contributions.

How Tier 2 Works:

The traditional CPP formula (Tier 1) remains in place for income up to the Year’s Maximum Pensionable Earnings (YMPE). Tier 2 contributions apply to income above the YMPE, up to a newly introduced Year’s Additional Maximum Pensionable Earnings (YAMPE).

What’s New in 2025?

- YMPE (Year’s Maximum Pensionable Earnings): $71,300 (up from $67,700 in 2024).

- CPP2 Tier (Year’s Additional Maximum Pensionable Earnings): Contributions apply to income between $71,300 and $81,200.

Contribution Rates:

- Base CPP: 5.95% for employees (11.90% for self-employed).

- CPP2 Contributions: 4.00% for employees (8.00% for self-employed).

Example: Self-Employed Earning $100,000

| Year | Base CPP Contribution | CPP2 Contribution | Total CPP |

| 2024 | $7,735.00 | $540.00 | $8,275.00 |

| 2025 | $8,068.20 | $792.00 | $8,860.20 |

Impact for Small Business Owners: If you’re self-employed, you pay both employee and employer portions. For 2025, your CPP contributions will increase by $585.

3. RRSP Contribution Limit Increase

Your Registered Retirement Savings Plan (RRSP) contribution room is determined by your earned income from the previous year, subject to specific limits set annually by the CRA. The RRSP annual contribution limit rises to $31,560 for 2025 (up from $30,780 in 2024).

Formula for RRSP Contribution Room:

(EarnedIncome×18%) – Pension Adjustment

Example 1: Salaried Employee

John earns $80,000 in 2024. His employer reports a Pension Adjustment of $6,000.

- Earned Income × 18% = $80,000 × 18% = $14,400

- RRSP Room = $14,400 – $6,000 = $8,400

Example 2: High-Income Salaried Employee

Sophia earns $200,000 in 2024. Since her income exceeds the RRSP annual limit for contribution purposes, the CRA cap applies.

- Earned Income × 18% = $200,000 × 18% = $36,000

- Maximum RRSP Limit for 2025 = $31,560

Sophia’s RRSP room for 2025 is capped at $31,560.

Check Your Notice of Assessment (NOA):

If you’re unsure of your available RRSP room, don’t stress—your CRA Notice of Assessment (NOA) will do the math for you. It lists your current room, including any carry-forward amounts from previous years. No need to dust off the calculator—you can leave the heavy lifting to the CRA.

(Unless, of course, you’re into math as a hobby. In that case, carry on!)

4. TFSA Contribution Limit Increase

The TFSA annual contribution limit increases to $7,000 in 2025, up from $6,500 in 2024.

Cumulative Contribution Room:

If you’ve been eligible since 2009 and have never contributed, your total room by 2025 is $102,000.

Example:

Maria has $20,500 in unused TFSA room from previous years. Adding the 2025 limit gives her $27,500 of total contribution room.

Check Your Notice of Assessment (NOA)

Not sure how much contribution room you have? Your CRA Notice of Assessment (NOA) will give you the exact amount, including any unused room carried forward from prior years. It’s a handy tool, so you don’t need to guesstimate your limits—let the CRA be your financial librarian!

Warning for Non-Residents

If you’re a non-resident of Canada, contributing to a TFSA can be a costly mistake. The CRA imposes a 2% penalty per month on overcontributions, including amounts added while you’re a non-resident.

Example:

Lisa moved to the U.S. in 2023 and contributed $6,500 to her TFSA in 2024. As a non-resident, she was hit with a 2% monthly penalty on that $6,500, amounting to $780 in penalties for one year.

Takeaway: If you’re unsure about your residency status, consult with a tax advisor before contributing to your TFSA. It’s always better to pause and confirm than to face penalties later.

5. First Home Savings Account (FHSA)

The First Home Savings Account (FHSA) combines the best of an RRSP and a TFSA:

- Contributions Are Deductible: Just like an RRSP, contributions reduce your taxable income.

- Withdrawals Are Non-Taxable: Similar to a TFSA, withdrawals are tax-free when used to purchase your first home.

What Counts as a “First Home”?

The FHSA isn’t limited to first-time buyers in the traditional sense. To qualify:

- You or your spouse/common-law partner must not have owned and lived in a home you owned in the past four calendar years.

Example:

Emma owned a condo five years ago but sold it and has been renting since. In 2025, she qualifies to open and use an FHSA because she hasn’t lived in an owned home for more than four years.

Contribution Rules and Carry-Forward Limits

- Annual Contribution Limit: $8,000.

- Lifetime Contribution Limit: $40,000.

- Carry-Forward Rule: Unused contribution room can only be carried forward to the next year. This means the maximum contribution in any year is $16,000 ($8,000 for the current year + $8,000 carried forward from the previous year).

Example:

Jason contributed $5,000 to his FHSA in 2024, leaving $3,000 unused. In 2025, he can contribute $11,000 ($8,000 for 2025 + $3,000 carried forward).

6. GST/HST Holidays for Certain Goods and Services

The Canadian government is promoting the GST/HST holiday as a great way to help families save this holiday season. From December 14, 2024, to February 15, 2025, many everyday items including:

- Children’s clothing and footwear

- Children’s diapers, car seats, toys, jigsaw puzzles, video game consoles, controllers, and physical video games

- Physical books and Printed newspapers

- Christmas and similar decorative trees

- Food and beverages and related services (Alcoholic beverages, candies, chips, popsicles, fruit bars, cakes, restaurants bills, etc.)

will be temporarily exempt from GST and HST.

Action Steps:

- Check whether your planned purchases qualify for GST/HST relief.

- Stock up on taxable groceries, plan restaurant visits, buy alcohol for business gifts!

Part 2: Updates for Real Estate Investors

7. Changes to Short-Term Rental Deductions (Airbnb)

New tax rules target short-term rental properties that don’t comply with local regulations. Effective January 1, 2024 and onwards.

Key Points:

- Non-Compliant Rentals: Properties that don’t follow local licensing or registration rules cannot deduct expenses like mortgage interest, property taxes, or maintenance costs.

- Compliant Rentals: Deductions are still available for rentals that meet local requirements.

Example:

John operates an Airbnb but hasn’t registered it with his city. Under the new rules, John cannot deduct $10,000 in expenses, increasing his taxable income and his tax bill.

Action Steps:

- Ensure your property complies with local regulations.

- Maintain proper documentation to support your tax filings.

8. Updates to Trust Reporting Requirements

The CRA has introduced enhanced reporting requirements for most trusts but has eased rules for certain types.

Key Points:

- Bare Trust Exemption: Bare trusts do not need to file T3 Trust Income Tax Returns for 2023 and 2024 unless specifically requested by the CRA.

- General Trust Reporting: Other trusts must file detailed information about trustees, beneficiaries, and settlors.

Example:

You are on your parents’ bank accounts, and the bank accounts have more than $250K. You’ll have filing obligation in 2025. Due date to file is March 31, 2026.

You’re the sole legal owner of the property. Neither your parents or your kids are on title. They are the one using the properties as their primary residence. FILING IS REQUIRED.

You’re on title to qualify for financing for your corporation. Your corporation is the beneficial owner.

You’re on title for a rental property that is co-owned between you and your joint venture partner.

You’re on title for a rental property that is co-owned between you and your spouse.

Refer to my Youtube video/Blog post for more detailed description.

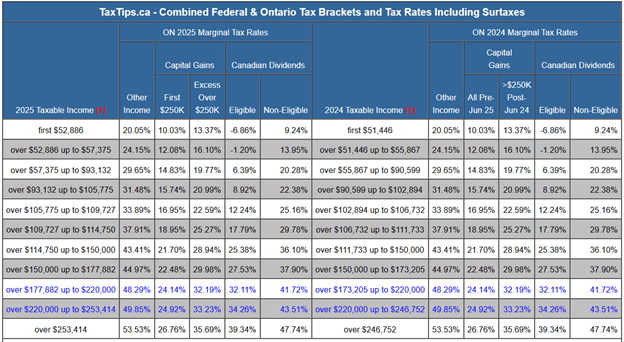

Key Changes to the Capital Gains Inclusion Rate

- For Individuals:

- Capital gains of up to $250,000 annually remain subject to the traditional 50% inclusion rate.

- Gains exceeding $250,000 are now subject to a 66.67% inclusion rate.

Example:

Alex, an individual taxpayer, sells shares for a $300,000 capital gain in 2025.

- First $250,000: 50% inclusion = $125,000 taxable.

- Excess $50,000: 66.67% inclusion = $33,335 taxable.

Total Taxable Capital Gain: $158,335.

This change increases taxable income for individuals with large capital gains, leading to higher tax bills for high-income earners.

- For Corporations and Trusts:

- The 66.67% inclusion rate applies to all capital gains realized by corporations and trusts starting June 25, 2024.

- These entities do not benefit from the $250,000 exemption available to individuals.

Example:

A real estate investment corporation sells a commercial property for a $400,000 capital gain.

- Entire $400,000 gain: 66.67% inclusion = $266,680 taxable.

This results in significantly higher taxable income compared to the pre-June 2024 rules.

Why This Matters: The Financial Impact

- Higher Tax Bills for High-Income Earners and Entities: Individuals, corporations, and trusts earning substantial capital gains will face larger tax obligations.

- Mid-Year Implementation: Gains realized before June 25, 2024 are not subject to the new rules. Timing the sale of assets may help minimize taxes.

Key Takeaways

- Plan Ahead for Tax Liabilities:

- If you expect significant capital gains in 2025 or beyond, start budgeting for higher tax bills now.

- Consider using tools like RRSPs, TFSAs, or FHSAs to shelter other income and offset increased taxes.

- Review Your Asset Sale Timing:

- If you can control when you realize capital gains, aim to structure sales below the $250,000 threshold for individuals.

- For corporations and trusts, assess whether sales can be completed in earlier tax years to avoid the higher inclusion rate.

- Optimize Deductions:

- Capital losses can offset taxable capital gains. Track all losses and report them to minimize the impact of the higher inclusion rate.

Action Step:

Whether you’re an individual, corporate investor, or trustee, these changes emphasize the importance of strategic financial planning. Consult a tax professional to tailor strategies for asset sales, capital gains management, and preparing for upcoming tax obligations.

Would you like a detailed guide or spreadsheet template to calculate the impact of these changes?

Final Thoughts

The 2025 tax updates bring new challenges and opportunities. Whether you’re an individual looking to maximize your RRSP or TFSA contributions or a real estate investor navigating changes to deductions and reporting, staying informed is essential success. By taking action now, you’ll not only save money but also set yourself up for a stress-free tax season in 2025.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant