A couple of weeks ago, we talked about how buying properties outside of Canada generally would not yield at double taxation. The only condition to avoid double taxation would be (1) right timing and (2) right structure.

So what is right timing?

The easiest to explain Right Timing would be using the 1031 exchange in the United States.

For those of your who don’t understand, 1031 exchange allows taxpayer to “exchange” your investment or income-producing property for another that is “like-kind” without paying tax. Your tax obligation for the first property is then delayed until you sell the last property that is exchanged.

This is like buying real estate on steroid. You get to defer the gain, save the taxes until the day you stop “exchanging” for like-kind property.

If this is available in the United States, would this be available for foreign investors, particularly Canadian investors, who purchase properties in the United States?

If you search online, lots of websites suggest that foreigners are eligible for the same 1031 exchange.

Now, let’s use an example to explain.

Say, you purchase a US property for CAD$300,000 5 years ago. You just sold the same property for CAD$500,000. You would like to use the 1031 exchange to defer taxes.

What would be the tax implication be?

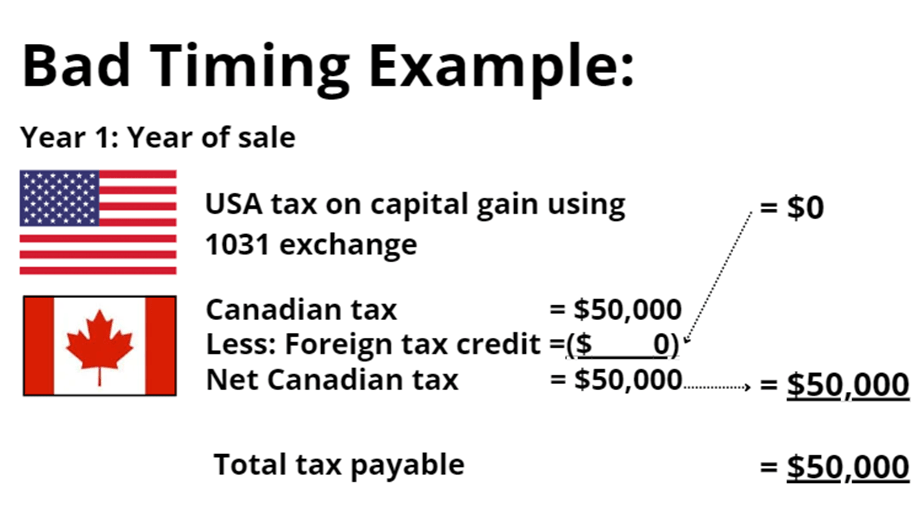

Since you choose to defer taxes by leveraging 1031 exchange and purchased a like-kind property, no tax is triggered in the United States side. You pay zero tax to the Internal Revenue Service. Yay! Exactly what you had hoped.

But you talk to your accountant in Canada, she stated that because you sold a property in the US, you’re required to report the gain on the Canadian tax return.

So when you report the capital gain of $200,000, you now owe the Canada Revenue Agency $50K of tax payable.

Now, let’s continued on with the example. Let say the new property that you bought was purchased for $500,000. But the property didn’t appreciate much. Five years later, you decided to sell the property and your net proceeds after fees was the same $500,000. You didn’t make any money on the sale of your second property. And you decided that you’re done with investing in the US. .

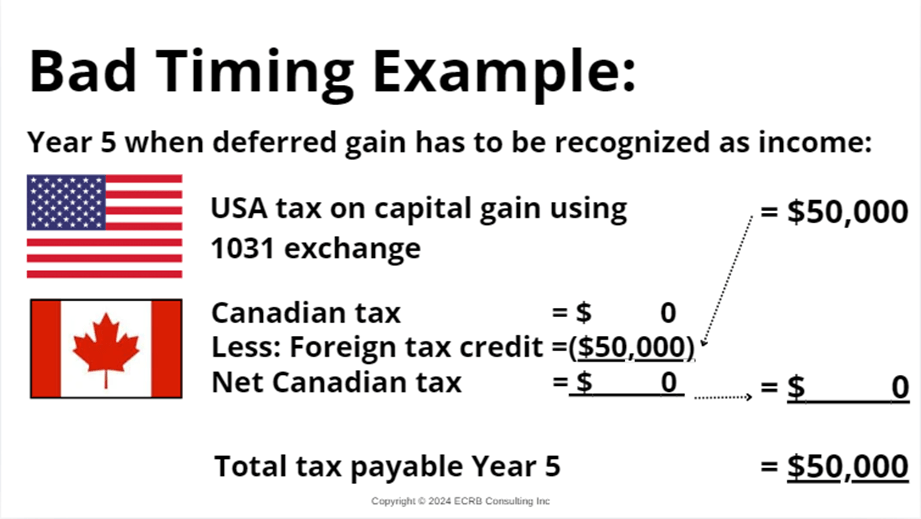

When you decide to exit the market altogether, your accountant reminded you that you have a bill to pay.

Remember the first property that you made $200K capital gain on? Well, it’s time to pay for the taxes when you decide to leave the market altogether.

Now IRS would like their share of tax and charge you $50K.

But… you already paid $50K to the Canadian government when you initially sold the property, no?

You should be able to use the amount that you paid to IRS to offset against the amount you already paid to the Canadian government!

But wait, because in Year 5, you have no US source income, you can’t use the $50K that you paid to IRS to offset against the Canadian tax liability on the US source income. You’re now stuck paying IRS $50K, but not getting any credit from the Canadian CRA!

Opps!

So Year 1 you paid tax to the Canadian government for $50K.

Year 5 you paid tax to US government for $50K.

Total payable = $100K. Double taxation!!!

What do you mean? You did Google search, 1031 Exchange is available to foreigners! Aren’t these websites wrong?

1031 Exchange is still available for Canadian investors. It’s just that it would trigger double taxation because Canadian government requires you to report all foreign property income/gain the year that you’ve earned them.

Stay tuned for Part 3 on how to best structure investment properties in the United States as Canadian investors. And mark your calendars! We’ll be hosting a learning workshop on October 19, Saturday, from 9 am to 12:30 pm on how to invest in the single-family home market in the U.S. It’s a great opportunity to learn firsthand about the numbers, the challenges, and what you can expect when diving into this market. Spots are limited, so don’t miss out!

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant