I recently had a casual conversation with my client. He’s currently working as a consultant for a small business who’s owned multiple stores in a grocery chain.

His clients often asked him, ‘where did my money go?’

As a business owner and a licensed accountant myself who prepares annual financial statements all the time, it is difficult to believe what is shown as profit number on the financial statements when we never truly see the money in our bank account.

Are you a business owner who has the same question – “where did my money go?”

Have you ever wondered why you’re seeing one number on your financial statements but seeing a radically different number in your bank account?

Have you ever had a nightmare finding out that you owe CRA a bunch of money and yet you have no money left in your bank accounts?

If you’re currently suffering from this “where did my profit go” syndrome, you’ve come to the right place.

Today, we are going to talk about this cash flow management system called Profit First system, a system that I have learned and implemented in my 5 businesses. And now I can sleep at night not worrying about paying for payroll and taxes. It’s all about cash flow at the end of the day – read article here if you want to learn more.

Now let’s get started. Let me tell you a personal story.

In 2011, I decided to leave my cushy job at the biggest grocery chain in Canada as a manager in their accounting department.

I decided to become a full-time real estate agent working primarily with my then boyfriend now husband’s real estate agent business.

I did fairly well, I made 6 figures the first year.

I was pretty happy about my business until tax time. I was hit by a really big tax bill at the end of the year. I got nothing left in my bank account.

As an employee, our employers are obligated to withhold all our tax obligation and send them to CRA on behalf of us on a monthly basis.

The salary we received from our employers is net of withholding taxes.

But when I became self employed individual, I’m the employer now. I’m the one that collects money directly from the customers and clients, including HST.

I have the responsibility to set aside the money to pay CRA, but I didn’t know that at the beginning.

I had to rush out to do a few more deals to pay for the CRA bill.

I’m ashamed to share this story. After all, I went to school just to study accounting. School taught us how to prepare a cash flow statement but they never taught us about how to manage our cash flow.

It was then I stumbled across this book called Profit First, written by Mike Michalowicz.

After reading this book, I immediately implemented the system across all my businesses.

And I’ve never needed to lose sleep at night worrying about money.

As a disclaimer, I’m not here to sell you Profit First system. I’m not affiliated with the author or the book.

I just thought that we, as small business owners, cannot afford NOT to implement this system in our lives to manage our cash flow better. Sure, there are always other options if the business returns seem to be going downhill – selling the business with help from brokers such as Ventura Business Brokers, for example. But that’s usually only a last resort; managing the business’ current cash flow is of prime importance when running a business to see some profits. So let’s get started.

Step 1: Setup five different bank accounts

First of all, we would need to setup five different bank accounts. Each bank account has its own purpose.

The first one, we use it to receive all of our income. The only purpose of this bank account is to receive income.

The second one is called tax account. You will use the funds to pay CRA tax instalment, your personal taxes as well and all HST balance.

Third one is called owners’ compensation account. You’ve started a business, you would have to hire someone to run your business.

Most small business owners start with rolling up their sleeves and putting in 80 hours a week to get the business running.

You can also choose to hire someone, instead of yourself to work in the business.

The purpose of the owners’ compensation account is to make sure we’re allocating some cash to paying yourself – the operator of the business.

As entrepreneurs, we often pay ourselves last. We should really learn to pay ourselves first.

4th account is called Profit account. This account represents the funds that you would set aside to reward you as an investor of your business.

It’s similar to the idea of you buying TD Bank stock, you buy the stock to earn dividend. You’re investing the TD Bank’s business.

This account represents the return on your own investment in the business as an investor.

The last but not least is the operating bank account.

All the business expenses, including payroll, rent, utilities, cell phone, internet bills are all coming out of this account.

Step 2: Setup your routine and allocation percentage

To implement this system, we need to change our habit, and start depositing all the revenue to the Income Account.

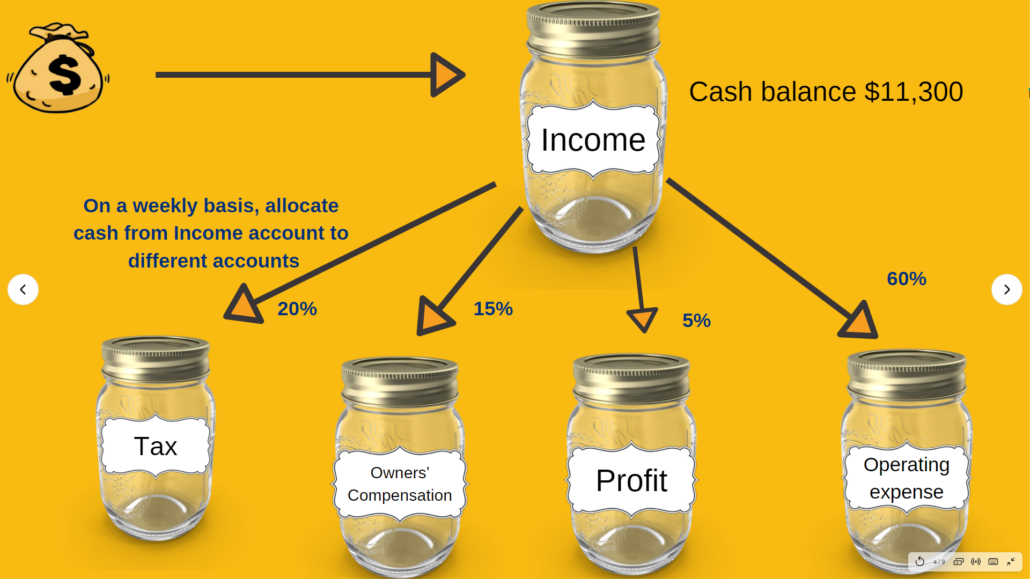

From the income account, on a periodic basis, can be weekly, bi-weekly or even monthly if you want, relocate the money in your income account to the various bank accounts based on a fixed set of allocation percentage.

Let’s use an example to explain.

Let’s say that I received $10,000 plus HST on an invoice, that is equivalent to $11,300.

I deposited the entire $11,300 to my income account.

My cash balance in the income account is now $11,300.

This process is mostly automatic. I setup my accounting software to deposit the cash into the income account.

On a weekly basis, I log into my online banking and start allocating my cash from income account to various account.

In this example, I allocate 20% of the total cash in my income account to the tax account

15% from income account to the owner compensation account

5% to profit account

And 60% to operating expense account.

This means that I transfer $2,260 to my tax account,

being $11,300 x 20% to the tax account

I transfer 15% to my owners compensation account, so it has $1,695 at the end of the day

I also transfer 5% to profit account

And I transfer 60% to the operating expense account to pay for rent, utilities, and all other operating expenses that I have.

This type of transfer has to happen regularly to make it effective.

Step 3: Name your bank accounts and hide them from you

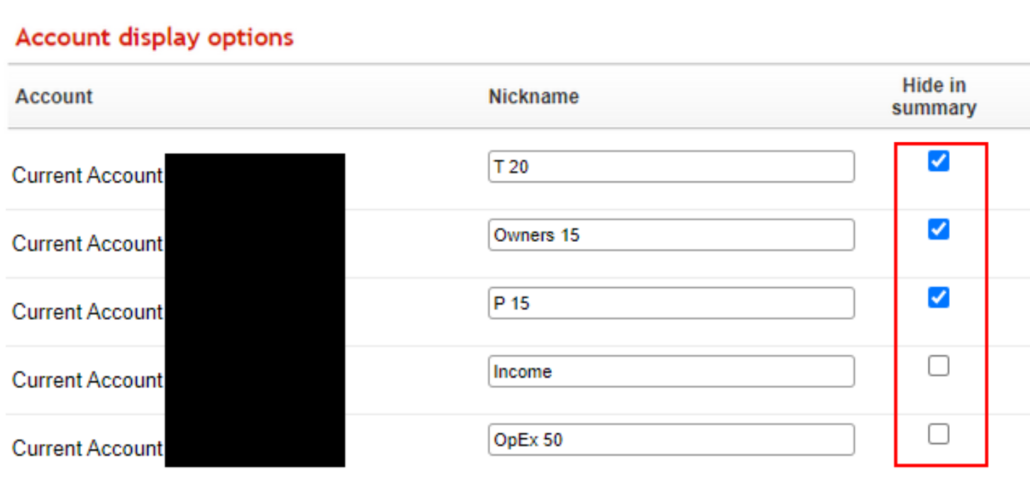

To make managing your cash flow better, the book Profit First suggested that we should rename our bank accounts accordingly.

Every bank is different. I use Scotiabank for my business.

I went into the setting to rename all five business bank accounts.

I name it “Income” account.

“OpEx” for operating expense. And I name the percentage that I allocate to that bank account, in this case, I am allocating 50% of the cash I collect to the OpEx account.

I named the owners compensation account as “Owners 15” as I am allocating 15% of all the incoming cash flow to the Owners compensation account.

Same goes to Profit account.

Lastly I named Tax account “Tax 20” just to remind myself that I will allocated 20% of my incoming cash flow for tax account.

The next step is to HIDE the accounts from you.

Scotiabank and I believe all the banks, have the function that allow you to hide certain bank accounts from the log in view.

I purposely hide Owners Compensation account, Profit account and Tax account from my login view.

The idea is that if these accounts are out of sight, they’re out of my mind. I wouldn’t think that I have so much money left that I can spend it all.

Tax account is CRA’s money, so I don’t want to see the balance and think that I can spend what I have in that account for my daily operation.

Everytime I pay CRA tax installment, both HST or income tax, the money come out directly from this tax account.

Everytime I pay my personal tax, it also comes out of this tax account.

This account balance does NOT belong to me.

I hide it, so it is out of sight, out of mind.

I also hide my Profit account. Profit account is return on investment. You can think of it as a saving account.

You allocate a portion of your incoming cash as saving on the side.

Once a year or every now and then, you’ll see how much profit you could save up over time.

You can reinvest the profit into the business, such as buying new equipment, setting up a new office, whatever it is.

You can also choose to take your family on a nice vacation at the end of the year.

The idea is to allocate the cash on a regular basis to this account, hide it from your view, and a year later, you get to see how much return you have on your investment.

Now, in terms of owners compensation account, I personally like to hide it from my view as well. I allocate what I am entitled from working in the business, I might not take it out personally because I want to minimize the amount of personal taxes I need to pay.

So more often than not, I have a good balance left in this account.

I want to hide it from myself so I won’t go on a spending spree and lose them all.

Step 4: Make adjustments accordingly

The allocation percentage you see is the sample one that I am using in my business.

Every business is different and your compensation and spending is different.

The idea is to start somewhere and implement it.

The book profit first has some sample allocation percentages for you to start with.

Once you have committed to a set of percentage, start implementing them, and if it doesn’t work, revisit it in 3 months.

You can always start small, and slowly make changes to the allocation percentage.

What is the outcome?

Once you have this system set up, you can simply log into your account, check your balance.

You can easily see your account balance and how much profit you have made.

You know that you have enough money set aside just for tax purpose.

You might even start accumulating profit and you can surprise your family using the cash in your profit account with a Disney trip.

The opportunity is endless.

What if you are not a business owner?

This entire system can be applied to your personal spending as well.

You can setup different accounts for different purpose.

You can have a dedicated household expense account that pay for your home mortgage, utilities, everything related to your house.

You can have a saving account that would keep growing for you.

A travel account just to allow you to allocate a portion of your income to the travel budget.

And an emergency fund just in case.

If you want to save for a new house, you could even have a dedicated bank account just for that particular saving purpose. The key is to hide it and allocate your funds on a regular basis. That said, one of the most crucial aspects of buying a new house (besides saving for it) could be looking for “off the market properties“. Off-market purchases can give you a higher chance of finding the perfect home since there is less competition; every home you see will be exclusive. Moreover, if you do not compete with other buyers, you can easily reach a mutually acceptable price with the seller. With this approach, you will have a better chance of finding a home that fits your budget.

Hopefully, all the information provides some insight to help you manage your cash and saving better.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant