I listened to Grant Cardone’s book the 10X Rule: The Only Difference Between Success and Failure.

It was intriguing. His idea was that we could set a goal a lot higher than what we think we could achieve, and you could still achieve it with the pretty much same amount of effort.

Love the 10X idea, but not so much about his not paying taxes idea 😉

Not that I necessarily want to ten times my revenue, but this book helps to open my mind up to new possibility.

I also really like the idea of taking total ownership of everything that happens in your life. A concept that I never understood when I was in my 20s.

Once you take ownership of things that happen to you, you are the one in control. Having control in your life will take a large amount of stress away.

As much as I like his book, but Grant Cardone isn’t always right…

He bought a jet, so he didn’t have to pay IRS. (For those of you who don’t know, IRS is the equivalent of CRA in the US.)

Google God said that his jet was going for roughly USD $26M right now.

This allowed him to wipe out all his income tax for that year (and he’s proud of it) – and probably the next few years. Why? And how?

This USD $26M asset would have been recorded as a “capital asset” on the business’s tax return. Based on the rules applicable back in 2016, he could write off this asset over 5 years.

This is USD $5.2M EVERY. SINGLE. YEAR for the next 5 years! That’s ridiculous! Now, some state tax information can vary so it’s likely he could do this in every state in the US but he obviously can in his state, which is why he’s done it.

(If you buy a jet from October 2017 onwards in the US, you are eligible to write off the entire expense immediately!)

In other words, his net income (after deducting all eligible expenses) would have to be over USD $5.2M before he would need to pay any taxes.

Sound like a great deal, isn’t it?

It prompts the question – should we go on a spending spree, so we don’t have to pay any taxes?

Contrary to common belief, paying the Tax man is a GOOD thing! It is indeed a FANSTASTIC thing.

Remember, if you lose money, you don’t pay tax.

If you need to pay a million dollar in tax, this means that your income is $2M at least.

If you pay a million dollar tax in the corporation running an active business in Canada, this means your business’ net income is around $4M.

Even after you pay $1M tax, you are still net with $3M!

If you were Grant Cardone, instead of keeping the $3M after tax cash, you would have used it on your jet and probably take on a large amount of debt as well.

Yes, he didn’t pay tax that year. But he spent all his profit, next year’s profit, the year after’s profit, and who knows how many years of profit on this jet?!

The truth is – when you make an investment or spending decision, it should not be purely based on the tax law.

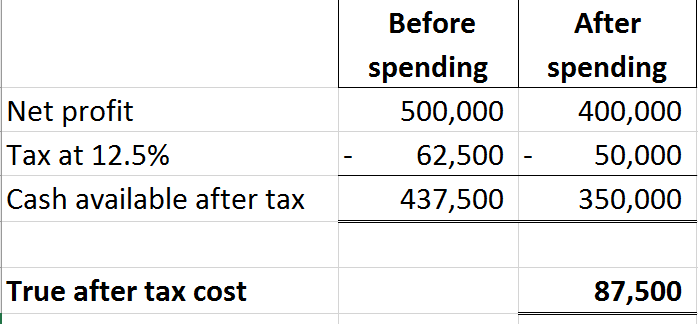

If you net $500K in your business, you owe $62,500 in the corporation (assuming your business is in a corporation being taxed at Small Business tax rate).

If you go out to spend $100K on advertising, your net income comes down to $400K.

Your tax owing comes down to $50,000, instead of $62,500. A delta of $12,500.

From a cash flow perspective, you net only $350K, instead of $437,500K.

In another word, you spend $100K to save $12,500!

This $87,500 is a TRUE after tax cost – out of your pocket type of expense. You bear this cost, after considering the tax effect.

Now, I am not saying you should not spend at all. If this advertising expense will generate a lot more revenue for you and it is a legitimate business expense, by all means, go ahead.

But if you are making the spending decision to avoid paying taxes, not a good decision!

Taking one step further, if you are trying to decide whether you should renovate an investment property, please make sure that this will generate enough return for you. Don’t do it for the tax write off!

(Rules around tax write off on renovation can be complicated, it may not even be a straight write off to begin with!)

If you are trying to decide to invest a property or not, don’t let the Tax Man be the decision maker! If you earn $100K upfront and pay 50% taxes, you are still ahead by $50K before you do the investment.

You may want to consult with an accountant to minimize your taxes before you do the investment.

You only need to pay tax if you make money.

Buying a jet for the business purpose may reduce your tax liability, but you’re left with a huge debt to pay. If there’s a legitimate business reason for it, by all means, do it.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant