The recent announcement by the Canadian Prime Minister about the GST rebate on new built is making waves. This move, particularly focused on new purpose-built rental housing, promises a major shift in the construction industry.

If you’re constructing properties with four units or more, you can now claim back 100% of the GST you’ve paid. I go through an example calculation, highlighting the substantial reduction in costs for builders with this new rebate. However, there’s more to the story.

For a while now, builders of purpose-built rental properties had to go through the taxing process of a self-assessment. This meant paying HST based on the property’s fair market value, adding an unnecessary financial burden on them. But, this is about to change.

What’s New with the GST Rebate?

The game-changer? Builders developing properties with four or more units can now breathe a sigh of relief. They can claim back an astounding 100% of the GST they’ve shelled out. This significant move by the government promises to substantially slash the out-of-pocket costs builders previously faced.

Breaking Down with Examples

To illustrate how these changes could affect the real estate landscape, let’s consider a real-world example:

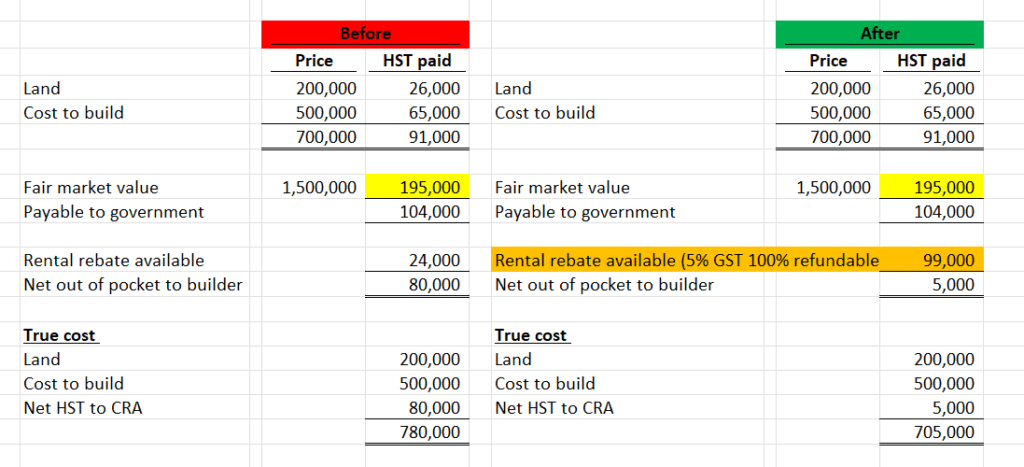

Scenario Before New Proposal:

- Land purchase: $200,000

- Construction cost: $500,000

- Total HST paid during construction: $91,000

- Estimated fair market value upon completion: $1.5 million

- Self-assessed HST on this value: $195,000

With the original framework, after taking available rebates into account, the builder would end up paying the CRA a net amount of $104,000. This means an out-of-pocket expense of roughly $80,000 for the builder due to GST/HST.

Scenario After New Proposal:

If the new rules were to be applied to the same example, the builder’s out-of-pocket GST expense could plummet to a mere $5,000, translating to savings of an impressive $75,000!

Criteria and Eligibility

All good things come with a set of rules, and the GST rebate is no different. For a project to qualify, it must consist of either:

- The construction project must commence after September 13, 2023.

- A minimum of 90% of the property’s units should be designated for long-term rental.

- Only properties with four or more units will qualify.

- Commercial-to-residential conversions are covered. However, subdividing a house into separate units doesn’t qualify.

- Single units, duplexes, triplexes, and housing co-ops are excluded from this rebate.

However, the enhanced GST rental rebate will not be available for substantial renovations of existing rental units, as the government believes that this would not incentivize an increase in supply.

The Enhanced GST Rebate:

The enhanced GST rebate is set to skyrocket from 36% to a complete 100% of the 5% GST. Moreover, the phase-out thresholds that previously existed are no more. Previously, builders could expect a rebate cap at $6,300.

Now, however, with the new rebate sitting pretty at 5% of the GST (and fully refundable), the math works completely differently.

If CRA is using the same criteria and same formula to calculate the GST rebate, using the same example from above, instead of paying over $100K out of pocket, the builder would be paying as little as $5K. A word of caution though, as of the date of this article’s publication, CRA has yet to release the formula on how to calculate the GST rebate on qualifying rental properties.

Rebate scheme uncertainties

But (and there’s always a but), the specifics of the calculations and finer points of eligibility are still shrouded in mystery. The rollout of such impactful legislation unsurprisingly leaves some questions. A primary concern revolves around the ambiguity of the term “construction begins.” With construction projects often spanning years, there’s a pressing need for clarity.

Here’s hoping for more comprehensive guidelines soon.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Tax Accountant