Recently, I came across a Global and Mail article “Why you should consider income splitting to lower the family tax bill” and I thought it would be nice to provide my two cents on what you can do immediately to lower your family tax bill.

Before we dive deep into these strategies referred in the article, let’s have a brief discussion on why income splitting is the key to lower your overall family tax bills.

Progressive tax system

Canadian personal income tax system is a progressive tax system.

What it means is that the more income you earn, the more tax you have to pay.

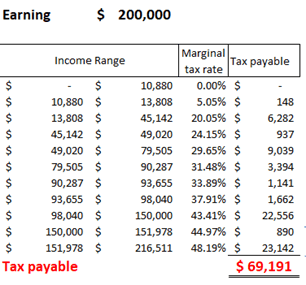

Let say you earn $200K salary income, the way your personal taxes are calculated is based on different tax bracket and the respective marginal tax rates.

The first $10,880 that you earned in Ontario in 2021, you pay zero dollar tax.

The $2,908 income you earned between $10,880 and $13,808, you pay 5.05% tax, which is equivalent to $148.

We then keep going with the same calculation until we reach the income level of $200K, who would need to pay $69K of income tax in 2021.

Yep, it is a lot of money. ☹

But there are some key learning lessons here.

Every Canadian tax resident has this exact same set of low marginal tax rates every year.

This means that, if you can somehow split income to as many taxpayers as possible, you will be able to lower your taxes.

If you are able to “spread” this $200K income to be reported by 2 people, each reporting $100K of income, each person is responsible to pay $23,454 income tax. Total taxes for 2 people together = $46,909.

Reporting $200K by ONE taxpayer – tax payable = $69,191

Reporting $100K each by TWO taxpayers – total tax payable = $46,909

Tax savings by “spreading the income” to two taxpayers = $22,192

So…tax planning is essentially about splitting your income to as many people as possible to utilize their low marginal tax rates.

If you don’t have that low income spouse, another strategy is to split that income with your future self, since you get to have a fresh set of low marginal tax rate the year after.

Now… what are the 5 simple tax strategies you can use to split income with your low income family members?

- RRSP and Spousal RRSP

High income earner can make spousal RRSP contribution, assuming that the spouse is earning less money.

Using the above example, high income spouse makes $200K annually. If he contributes $20K to spousal RRSP, he is able to save $20,000 * 48.19% (highest marginal tax rate) = $9,638 income tax.

The low-income spouse could potentially withdraw this RRSP three years later (assuming there’s no movement in the spousal RRSP plan), report this RRSP as income at a much lower rate.

Of course, a similar strategy can be applied for yourself to split income with your future self, especially for real estate investors who are planning to quit their full-time job in the near future.

Contributing to RRSP and withdrawing from it when you earn low income can be an effective way to lower your overall tax bill.

- TFSA

We all know the benefits of contributing to a TFSA account.

We also know that investment income you earned from TFSA can be tax free for the most part.

If you are the high income earner, you can make contribution to your spouse or family members’ TFSA account, income earned in the TFSA account is not attributed back to you personally.

- Spousal loan

High income earner can lend money to the low-income spouse, who in turn, uses the borrowed money to invest and earn higher income.

Investment income will NOT be attributed back to the high-income earner, as long as the taxpayers setup this arrangement and follow through with all the compliance requirement.

Currently, CRA requires the high income earner to charge 1% interest (prescribed rate as set out by CRA).

Yes. The high income earner reports 1% interest income.

But, the low income spouse makes 5% to 10% return, deducts 1% expense paid to high income earner and pay taxes on the spread at low marginal tax rate.

And… you’re splitting income legitimately!

- Family Trust/Corporation

Income splitting using family trust and corporation isn’t nearly as easy as in the past.

But there’re still ways that you can split income with your family members.

Spousal loan arrangement can still be made to the family trust/corporation to allow for income splitting purpose.

Family trust/corporation invests the funds for higher return, pays 1% interest to the high income earner/business, and the net investment income can then be report in the hands of adult children at low marginal tax rates.

- Pension income splitting

If you are receiving pension income, you might be qualified to split up to 50% of your pension income with your spouse.

Generally speaking, you must reach the age of 65, but your spouse can be younger.

On top of the savings from reporting a portion of the income from lower income spouse,

For the lower income spouse who’s “receiving” the pension income allocated by the higher income spouse, if he/she is over the age of 55, he or she will be entitled to $2,000 tax credit, which is equivalent to $400 tax saving.

Income splitting isn’t necessarily for the wealthy, like the article suggested. If you look hard enough, there’re always ways to split income legitimately and lower your overall family tax burden.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant