A couple of months ago, I met with a real estate investor for an initial consultation.

As part of the process, I asked him what his long-term goals are. He said, “I would like to give up my job one day to volunteer full time and give back to the community.”

I’ve met hundreds of investors. I’ve never met one of them that contributing back to the community would be the goal from real estate investing.

He wasn’t trying to brag about his goal or anything. At the end of the day, this conversation happened during a one-on-one meeting. No one, except me, heard that.

As some of you may know, Erwin and I and a bunch of friends started Basket Brigade Charity a few years back.

We started in Roger Auger’s home delivering food baskets to 34 families in Christmas 2014. Most the donation at the time (we were not a registered charity) was donation received from our network, all real estate investors.

Without receipts, we were able to raise enough funds for years, all from real estate investors.

We’ve since become a registered charity.

We changed the format in Thanksgiving, aiming to provide bigger and more lasting impact to the more underprivileged families in Hamilton area.

A few families visited the school where we hosted the event to join the party.

Roger Auger, one of the board members, brought out his hot dog stand and provided free hot dogs to everyone there.

Burlington Batman volunteered to dress up in his full gear and surprised the volunteers and families.

The school board volunteered the space for us to host the event.

Nancy & Elizabeth, part of schools and our charity board, spent hours organizing the families who’re in need to receive the supplies.

James & Tammy led their respective teams for smooth volunteer experience.

Erwin, my husband, who dedicated hours in terms of fundraising and organizing the events.

It’s a collective effort to make all of these happened.

We saw a mom in tears when she received a pair of new boots for herself. She said that she had not had a pair of new boots since she was a teenager.

We saw a 6-year-old kid’s priceless smile when she kept unwrapping her gifts carefully selected by our volunteer.

We saw a teenager excitedly putting on her new jacket.

It’s so heartwarming to see we’re making a difference in the community.

To make such a big impact on each of the family, the budget to purchase clothes, jackets, shoes, toilet paper, cleaning supplies, sometimes underwear, is about $500 per family.

I was the one responsible for reimbursing all the volunteers. Over 90% of volunteers went above and beyond the budget knowing that they would only be reimbursed for the budget amount.

We’re trying our best to make it happen at Christmas again. We need your help.

Cash in the bank only allows us to support 19 families this time around. We hope that you can make a donation to our charity so that we can make a bigger impact this Christmas.

You can make a donation here.

Thank you in advance for those who are willing to help.

Now, onto this week’s topic – The Dangers of deducting losses from the rental business.

A couple of years back, I advised a real estate investor not to take the entire apartment renovation as a one-time deduction.

The renovation was done in between tenancies. He didn’t put much improvement except giving the unit a fresh look.

Technically speaking, he could deduct it as repairs.

I looked at it differently.

He reported multiple years of losses. His other rental property also had a huge expense creating a bigger overall rental loss (at the time it was over $50K of rental loss that year).

He’s self-employed as well, which means that he was at a higher risk of being audited.

He disagreed with my judgement.

People generally underestimated the amount of work involved in handling an audit. They also underestimated the stress it would add on to your life.

This recent court case in Hamilton reminded me of this client.

This taxpayer owned a few rental properties in Hamilton and Stoney Creek area.

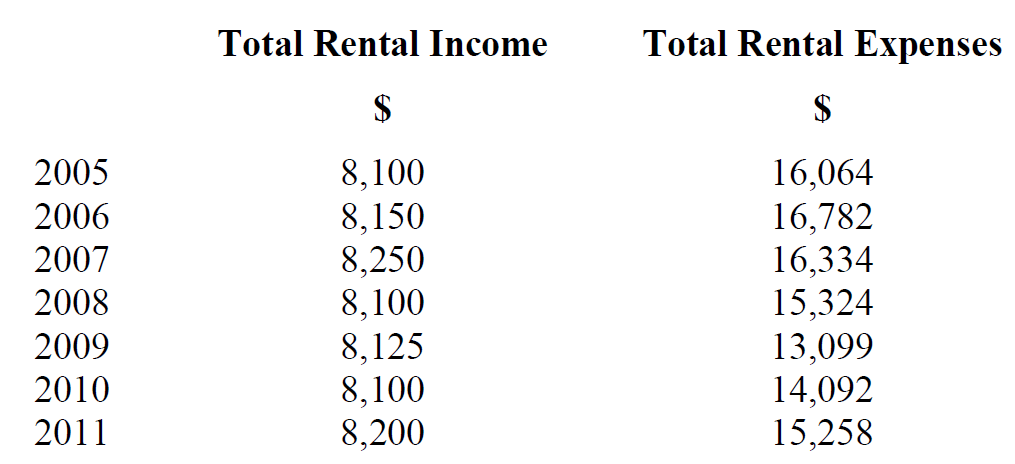

He reported rental losses from 2005 to 2011 (see below for a summary).

He rented out two properties at significantly below market rent.

He rented out these properties, detached bungalows, for $450 per month for the most part, during the questioned period.

He rented one of these properties to his lease for $200 per month.

CRA presented in court that market rent as per CMHC, which we all know as real estate investors are way low, is around $850 per month during the period. The taxpayer simply argued that his rent was charged on a net basis with the intention that the tenants are responsible for utilities, snow removal and day to day maintenance of the properties.

He stated in court that his objective for these rentals was to “recover property taxes, mortgage interest and insurance”.

As a result, he reported significant losses in multiple years. CRA audited his tax returns and challenged that he did not intend to carry on the rental with the intention to profit.

If you’re not intending on carrying the rental activities in a commercial manner, this means that you cannot deduct the rental losses incurred.

Losses offset against his income. If these losses are disallowed, that means he must pay back all the taxes he would otherwise be liable if he didn’t have these losses.

Judge didn’t think that he was carrying out his rental activities in a business-like manner.

- He didn’t have any actual leases signed.

- He didn’t make any attempt to determine comparable rent being charged in the Hamilton area.

- He also failed to increase rent even though he’s incurring a loss every year.

- He rented out one property to his niece for $200, significantly lower than what other tenants are paying, much lower than the fair market value rent.

- The judge concluded that the taxpayer did not provide any proof that he was conducting his rental activities in a commercial manner.

The judge dismissed the taxpayer’s appeal and sided with CRA.

Next time when you are reporting multiple years of losses – whether it is rental or business, think again.

Next time when you are renting your properties to family members and reporting losses, think again.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant